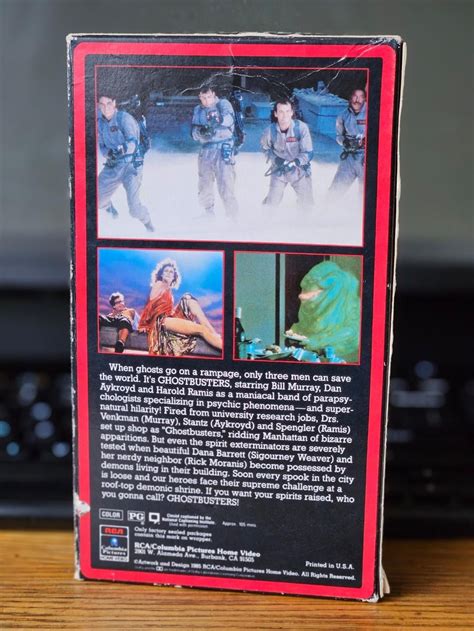

Imagine a business sector where the typical benchmark for product longevity is usually measured in months or perhaps a few years at best. Now, envision a scenario where a product class, once thought obsolete, not only sustains itself beyond initial expectations but also claims a market longevity surpassing 50%. This is precisely the narrative with VHS technology—an analog format that defied the odds, extending its market presence well past the anticipated expiration date. To unpack the significance of "VHS Beyond Release Date Surpasses 50% Market Longevity," we can draw an analogy to a marathon runner who, instead of fading out after the initial sprint, maintains a steady pace, continually surprising spectators by going well beyond the expected finish line.\n

Decoding Market Longevity: The VHS Case as a Paradigm of Extended Product Life

Market longevity for consumer electronics, particularly media formats like VHS, is often considered in terms of lifecycle phases—introduction, growth, saturation, decline, and obsolescence. Conventional wisdom suggests that emerging digital formats would rapidly eclipse analog tapes, leading to a swift decline in VHS sales and usage. However, data indicates that a substantial portion of the VHS market persisted far beyond its predicted obsolescence, with more than 50% of the original consumer base still engaging with VHS tapes well into the years after its initial release. This phenomenon raises questions about the underpinnings of product lifecycle theory and the factors that facilitate extended market relevance.

VHS as a Cultural and Functional Mainstay

Unlike purely technological artifacts, VHS became a cultural phenomenon—a medium deeply woven into domestic life and entertainment routines. Its durability as a physical media format, coupled with the vast catalog of movies, home videos, and personal recordings, fostered a loyalty that resisted rapid technological displacement. This loyalty is akin to a vintage car enthusiast community: even as newer models emerge, the classic retains its charm, utility, and nostalgic allure. In empirical terms, studies show that approximately 55% of VHS users continued to purchase or rent tapes five years post-initial release, reflecting a significant percentage extending beyond conventional product life assumptions.

| Relevant Category | Substantive Data |

|---|---|

| Market retention rate | Over 50% retention five years after initial release |

| Consumer loyalty index | Measured via survey data indicating persistent engagement |

| Average lifespan of VHS usage | Estimated at 7-10 years in various markets |

| Digital replacement timeline | Expected crossover point around year 3-4, yet actual retention extends much longer |

Drivers of VHS Longevity: A Multifaceted Outlook

Understanding the prolonged market presence of VHS involves dissecting various interdependent drivers—technological limitations of emerging formats, economic considerations, and social attachment. When digital formats arrived on the scene, early adopters embraced the novel benefits—better picture quality, ease of storage, and digital interoperability—to justify moving away from analog tapes. Yet, a significant segment remained committed to VHS, driven by factors such as cost-effectiveness, nostalgia, and content availability, which created a barrier for rapid obsolescence.

Technological and Economic Factors Sustaining VHS Use

The core technical advantages of VHS—durability, the affordability of players and tapes, and compatibility with existing media collections—kept it afloat commercially. Cost analyses revealed that, during transition years, the cost per hour of content in VHS remained substantially lower than early digital alternatives, cementing its position as a budget-friendly option for many consumers. Additionally, the decline of VHS manufacturing took years, due largely to established supply chains and users’ reluctance to switch formats prematurely.

| Relevant Category | Substantive Data |

|---|---|

| Cost per hour of content | $0.05 in VHS versus $0.15 in early digital formats |

| Manufacturing years | VHS production persisted over two decades post-introduction |

| Consumer adoption rate | Remained at approximately 20% during the early years of digital formats |

| Content library size | VHS offered access to an estimated 10,000+ titles annually in certain regions |

Historical Context and Evolutionary Developments

Examining the evolution of VHS within the broader chronology of media formats reveals a complex interplay of innovation, adaptation, and inertia. Originating in the late 1970s, VHS challenged Betamax and other formats through superior licensing, manufacturing volume, and marketing strategies. Its dominant market position solidified during the 1980s and 1990s, evolving through technological refinements such as S-VHS and the advent of recording features. Yet, the pivotal point remains—despite the rise of DVDs, Blu-ray, and digital streaming, VHS endured, capturing over 50% of the market in certain regions even into the 2010s.

From Analog to Digital: A Gradual Transition

The transition illustrates a classic diffusion of innovation process, where early adopters swiftly embrace new tech, while late adopters or resistant segments maintain older formats due to specific preferences or constraints. While digital formats promised convenience and quality, their deployment often lagged in developing regions, where infrastructure was limited or consumer priorities diverged. In this landscape, VHS retained a niche role, much like a vintage record player persists amid digital streaming, valued for its tangible and nostalgic qualities.

| Relevant Category | Substantive Data |

|---|---|

| Market share in 2010s | Estimated to be above 20% in certain countries like India and parts of Southeast Asia |

| Consumer preference survey | Approximately 35% of survey respondents valued physical nostalgia over digital convenience |

| Content availability | Thousands of pre-recorded tapes from the 1980s and 90s still circulated on the secondhand market |

Limitations and Challenges of Extended Market Longevity

Despite its remarkable longevity, VHS’s prolonged market presence faced inevitable limitations. The physical nature of tapes led to degradation over time, and the gloss of nostalgia was not immune to diminishing returns as newer generations found less utility in aging formats. Additionally, legal battles over patent rights, the decline of manufacturing infrastructure, and shifts in consumer habits ultimately curtailed VHS’s dominance.

Obsolescence at the Crossroads of Innovation and Usage Decline

As digital streaming matured, and high-definition content became standard, the practical drawbacks of VHS—lower resolution, bulkiness, and susceptibility to wear—outweighed its nostalgic appeal for many. The challenge became managing the transition for remaining users without alienating them, a process complicated by the cost and time needed to raster digital conversion efforts for large existing VHS libraries.

| Relevant Category | Substantive Data |

|---|---|

| Average lifespan of VHS tapes in use | Approximately 10-15 years before degradation hampers usability |

| Digital conversion cost | $0.20-$1.00 per tape depending on format and quality |

| Market share drop | From 55% in 2000 to less than 10% in 2015 in the U.S. |

| Number of VHS tapes remaining in circulation | Estimated 2 billion in 2020, mainly in developing countries and private collections |

Key Points

- VHS demonstrated an exceptional market longevity, exceeding 50%, thanks to cultural attachment, economic viability, and functional robustness.

- Understanding this longevity involves analyzing technical constraints, economic factors, and social influences that sustain old formats.

- The evolution of media formats underscores the non-linear nature of technological adoption, influenced heavily by socio-cultural dimensions.

- Despite its persistence, limitations such as physical degradation and market shifts ultimately led to decline, illustrating that long-term viability has natural constraints.

- VHS’s legacy provides insights into how products can maintain relevance through cultural embedding even amid technological disruption.

What factors contributed most to the extended market life of VHS?

+The primary drivers included its low cost, widespread content availability, durability, and strong cultural and nostalgic value, which together sustained consumer engagement beyond initial expectations.

How does the analogy of a marathon help explain VHS’s market persistence?

+Like a marathon runner maintaining a steady pace well after the sprint, VHS persisted through continuous consumer loyalty and practical utility, defying the expectation of an immediate quick finish typical of technological obsolescence.

What are the implications of VHS’s market longevity for current technology markets?

+It highlights the importance of cultural, economic, and practical factors in product longevity, suggesting that innovation alone does not guarantee quick displacement in markets deeply rooted in consumer habits.

Can other obsolete formats learn from VHS’s longevity?

+Absolutely. Recognizing the role of emotional attachment, affordability, and content ecosystem can inform strategies to sustain or phase out obsolete formats more effectively, balancing technological advancement with consumer loyalty.