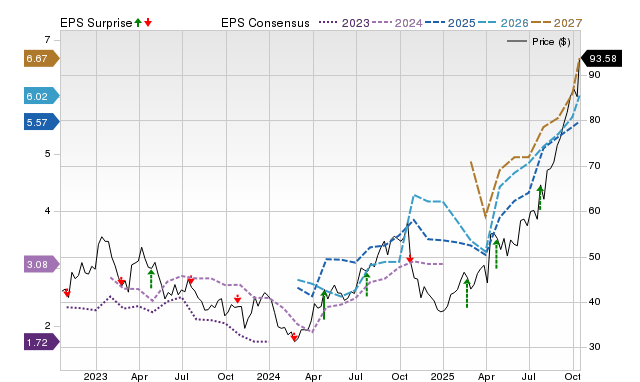

In a small manufacturing town nestled between rolling hills and the persistent hum of industry, Mike, a seasoned financial analyst, had learned to read earnings releases not as mere corporate updates but as vital signals of economic health. Yet, even with years of experience, he found himself puzzled by one persistent anomaly: the timing of Valmont Industries' earnings release. Unlike other companies that adhered to predictable calendars, Valmont’s announcement dates often seemed to defy expectations, puzzling investors and analysts alike. This pattern prompted a deeper investigation, revealing a layered strategy shaped by operational nuances, regulatory considerations, and corporate communication philosophies. For those tracking industrial financials or trying to time investments, understanding why Valmont Industries’ earnings release date isn’t when you expect can unlock nuanced insights into broader market behaviors and corporate transparency strategies.

Understanding the Variability of Earnings Release Dates in Industrial Conglomerates

Valmont Industries, a global leader in infrastructure, agriculture, and utility support solutions, exemplifies how a company’s operational complexity influences the timing of financial disclosures. While the average publicly traded manufacturing firm might release earnings reports on a quarterly schedule aligned with historical tradition or investor expectations, Valmont exhibits a pattern that reflects both unique internal processes and external pressures.

Fundamentally, earnings release dates serve multiple strategic purposes: regulatory compliance, internal reporting cycles, investor relations, and market positioning. For conglomerates like Valmont, each division—ranging from engineered support structures to precision agriculture—has distinct operational timelines and data consolidation routines. Harmonizing these disparate streams into a cohesive quarterly report involves scheduling that may not align with standard calendar quarters, leading to variations that can appear irregular to external observers.

The Internal Dynamics and Operational Cycles Influencing Release Timing

Valmont’s operations span continents, with manufacturing plants, R&D centers, and sales offices operating across various time zones and regulatory jurisdictions. This diversity necessitates a flexible earnings release schedule. For example, a key North American division might complete its quarter-end activities by the 15th of a month, whereas Asian or European divisions might conclude theirs by the 25th. The collation process, audit finalizations, and board approvals are often staggered accordingly.

Moreover, operational disruptions, such as supply chain delays or unexpected macroeconomic shifts, can further influence the timing of financial data availability. For instance, a global supply chain disruption might delay the finalization of inventory valuations or receivables, consequently pushing back the scheduled release date. This flexibility, while vital for accuracy and integrity, can frustrate analysts expecting consistency.

| Relevant Category | Substantive Data |

|---|---|

| Average Release Delay | Varies between 1-4 weeks from standard quarter-end, depending on operational complexity and external factors |

External Factors Shaping Earnings Release Scheduling

Beyond internal dynamics, external influences heavily impact the timing of Valmont’s financial disclosures. Regulatory environments, especially in regions with stringent financial reporting standards, can introduce procedural delays. Additionally, macroeconomic events, such as political upheavals, financial market volatility, or global crises, tend to prompt companies to reschedule releases to ensure comprehensive and accurate reporting.

Regulatory Compliance and Its Role in Schedule Flexibility

Valmont Industries, listed on the New York Stock Exchange, adheres to SEC regulations requiring quarterly financial filings. However, SEC rules provide a flexible window—up to 40 days post quarter-end—to release earnings, which is a broader margin than many expect. This temporal elasticity is utilized by firms like Valmont to ensure all disclosures are robust and comply with GAAP standards and audit expectations.

Furthermore, cross-border subsidiaries may face local reporting deadlines, adding layers of complexity, especially when consolidating financials. For instance, European subsidiaries may have different fiscal year calendars, causing the parent company’s overall schedule to shift, sometimes unexpectedly.

Market Timing and Strategic Communication

Choosing a release date is not solely a procedural matter; it is often a strategic decision. Companies might opt to release earnings after market hours to avoid immediate market volatility or to coincide with industry events, analyst conferences, or investor days. In some cases, delaying or advancing a release serves to mitigate negative news or capitalize on favorable market conditions.

| Relevant Category | Substantive Data |

|---|---|

| Average Delay for Regulatory Filing | Typically 30-40 days post quarter-end, given compliance and audit processes |

Implications for Investors and Market Dynamics

The unpredictability surrounding Valmont Industries’ earnings release date has tangible implications for investors. Timing discrepancies can impact trading strategies, especially for those employing quantitative models or high-frequency trading algorithms designed around scheduled announcements. Last-minute delays may induce market anxiety, while premature releases—sometimes via accidental leaks—can trigger volatility.

Moreover, delayed disclosures can mask underlying financial performance issues, prompting suspicion or speculation among analysts and shareholders. Conversely, well-communicated delays embedded within strategic narratives can reinforce investor confidence if positioned transparently.

Best Practices in Navigating Irregular Release Schedules

Proactive investors monitor not only scheduled dates but also company hints, forward-looking statements, and regulatory filings, such as Form 10-Qs and 8-Ks, to glean insights ahead of officialearnings reports. Employing a flexible analytical approach that accounts for potential restructuring of release timelines minimizes surprises and enhances decision-making robustness.

| Relevant Category | Substantive Data |

|---|---|

| Market Response to Timing Shifts | Historically, delays correlate with increased volatility; timely, transparent communication reduces market backlash |

Historical Context and Evolution of Earnings Disclosure Practices

The paradigm of earnings release timing has evolved significantly over the past decades. In the early 20th century, annual reports sufficed, published with little regulatory scrutiny. As markets matured and regulatory bodies strengthened oversight—culminating in the SEC’s establishment in 1934—quarterly reporting became a standard, fostering transparency but also introducing procedural complexities.

In recent years, technological advances and the rise of real-time data dissemination have challenged traditional schedules. Companies increasingly adopt rolling disclosures and proactive investor communications, shifting away from rigid calendar slots. Valmont Industries exemplifies this trend, using flexible disclosure timing to prioritize comprehension and accuracy over predictability.

Integrating Regulatory Developments and Industry Standards

The SEC’s Regulation Fair Disclosure (Reg FD) and advancements in compliance technology have empowered firms to release material information in a manner that balances transparency with strategic discretion. These developments have made the timing of earnings releases both more flexible and more scrutinized, emphasizing the importance of consistent, credible communication strategies.

| Relevant Category | Substantive Data |

|---|---|

| Impact of Regulation | Greater flexibility in timing, with emphasis on transparency and equal access for all investors |

Key Points

- Interplay of operational complexity and external factors influences Valmont's earnings release timing.

- Regulatory adherence provides flexibility that can cause schedule variability, impacting market perception.

- Strategic delays may be used for market positioning, not merely procedural necessity.

- Investor agility is essential to adapt to unpredictable disclosure timelines and maintain a competitive edge.

- Historical evolution of reporting practices highlights a shift toward transparency and technological integration.

Why does Valmont Industries sometimes delay its earnings release beyond the expected date?

+Such delays often result from operational complexities, cross-region reporting requirements, or strategic communication choices aimed at ensuring accuracy and regulatory compliance.

How should investors interpret unexpected changes in Valmont’s earnings release schedule?

+Investors should consider external factors, internal operational cycles, and strategic communication motives, understanding that schedule shifts do not necessarily indicate negative performance.

What best practices can investors adopt when dealing with irregular earnings release dates?

+Monitoring regulatory filings, listening to company guidance, and maintaining flexible analytical models help investors navigate unpredictable timing effectively.

How have regulatory standards influenced earnings reporting schedules historically?

+Regulatory developments, including SEC rules and technological advancements, have increased transparency and allowed more flexible, strategic timing of disclosures.