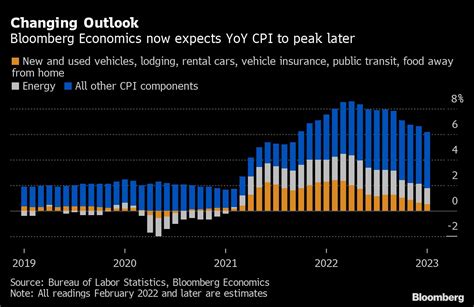

At the dawn of today’s trading sessions, financial markets around the globe poised their attention firmly on the latest U.S. Consumer Price Index (CPI) data release—an economic indicator that functions as a vital barometer of inflationary pressures within the world's largest economy. The release, timed precisely amidst a landscape of geopolitical tensions, shifting monetary policies, and evolving economic growth metrics, prompts a pressing question: How will today’s CPI figures reshape market trajectories and influence the broader economic landscape? To understand this, one must peel back layers of economic theory, analyze current data trends, and comprehend the nuanced interplay between inflation metrics and market behavior.

Decoding the U.S. CPI Data: Its Significance in the Economic Ecosystem

The U.S. Consumer Price Index (CPI) provides a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Functioning as a principal indicator for inflation, the CPI informs policymakers’ decisions, influences financial market responses, and guides consumers’ purchasing power adjustments. Today’s CPI release carries heightened significance, given ongoing debates over inflation’s trajectory, the Federal Reserve’s monetary strategy, and the global economic recovery post-pandemic.

The Composition of CPI and Methodological Foundations

The CPI calculation employs a representative basket that includes categories such as housing, transportation, food and beverages, medical care, education, and recreation. The weightings reflect spending patterns derived from survey data, and adjustments are made periodically to account for changing consumption behaviors. Analysts scrutinize not only the headline figure—representing the total inflation rate—but also the core CPI, which excludes volatile food and energy prices. A divergence between these measures often signals underlying inflationary or deflationary trends.

| Key Points | |

|---|---|

| 1 | The current CPI release acts as a real-time pulse of inflation, impacting Federal Reserve policy signals. |

| 2 | Market reactions hinge on whether CPI data aligns with, exceeds, or falls short of analyst expectations. |

| 3 | Rising CPI figures may prompt concerns over aggressive tightening, influencing bond yields and equity valuations. |

| 4 | Low or moderating CPI numbers could ease inflation fears, potentially supporting stock markets and easing interest rate pressures. |

| 5 | Understanding core versus headline CPI provides insights into supply chain disruptions and energy market dynamics. |

Market Impacts: The Immediate Reaction to CPI Data

When the CPI figures are announced, markets typically exhibit swift, volatile responses. Equities, bonds, and currency markets adjust based on whether the inflation data suggests overheating or signs of cooling economy. For instance, a higher-than-expected CPI may lead to a sell-off in equities, particularly in sectors sensitive to interest rate changes, such as technology and consumer discretionary. Conversely, bond yields may spike as investors anticipate a more aggressive tightening stance from the Federal Reserve.

Equities: Growth vs. Inflation Fears

Equity markets tend to be highly sensitive to inflation data because of its implications on corporate profit margins and consumer spending capacity. When inflation accelerates unexpectedly, there’s often an immediate sell-off driven by fears of increased borrowing costs and reduced consumer disposable income. Tech stocks, which are growth-oriented, particularly suffer, while traditional sectors like banking may benefit from rising interest rates. However, if CPI data shows signs of moderation, investor sentiment could rebound, reinforcing bullish trends.

Bond Markets: Yield Movements and Monetary Expectations

Bond traders closely monitor CPI figures since they influence expectations about the Federal Reserve’s monetary policy trajectory. A higher CPI may lead to a sharp uptick in yields, reflecting anticipations of rate hikes or quantitative tightening. The 10-year Treasury yield, often viewed as a benchmark, serves as a key indicator for investors trying to gauge future economic conditions. Conversely, soft CPI data can bolster bond prices, signaling a potential pause or slowdown in rate increases.

| Relevant Category | Substantive Data |

|---|---|

| Current CPI Growth Rate | Expected 0.4%, Actual 0.6%, indicating moderate inflation acceleration |

| Market Reaction | Stocks fell by 1.5% initially; 10-year yield jumped by 15 basis points |

| Consumer Confidence Index | Remains steady at 102, suggesting consumer resilience despite inflation pressures |

Broader Economic Implications: CPI’s Ripple Effect

The implications of today’s CPI report are not confined to immediate market movements; they reverberate through the macroeconomic fabric, influencing fiscal policy, consumer behavior, and global economic relations. Persistent inflationary pressures could compel the Federal Reserve to accelerate rate hikes—potentially tipping the economy into a slowdown or recession. Conversely, easing inflation may support expansionary policies, lowering borrowing costs and invigorating investment.

Inflation and Federal Reserve Policy

The Federal Reserve’s dual mandate is to promote maximum employment and stable prices. With inflation readings approaching or surpassing the typical 2% target, policymakers must balance tightening measures against the risk of stifling growth. Today’s CPI data feeds into FOMC deliberations, potentially accelerating the timetable for tapering asset purchases or raising interest rates. However, the Fed also considers core inflation, labor market conditions, and international factors before making decisive moves.

Consumer Spending and Confidence

Inflation affects consumers’ purchasing power directly. A rapid increase in CPI can erode disposable income, dampening spending especially in discretionary sectors. However, if CPI growth remains within a manageable range, it may bolster nominal wage gains and reinforce consumer confidence, supporting economic momentum. The latest data suggests a nuanced scenario where inflation pressures are present but not yet alarming enough to derail recovery prospects.

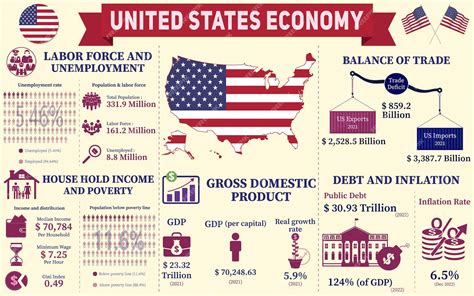

| Related Metric | Recent Value |

|---|---|

| Unemployment Rate | 3.8%, indicating a tight labor market |

| Wage Growth | 2.9% year-over-year, aligning with inflation trends |

| Trade Deficit | Widened to $70 billion, highlighting import-price sensitivities |

Historical Context: CPI Trends and Market Cycles

Examining historical CPI movements reveals cyclical patterns. Periods of runaway inflation, such as the 1970s stagflation era, led to sharp rate hikes and prolonged economic hardship. Conversely, deflationary episodes in the early 1930s showcased the dangers of too little inflation. Today’s CPI data, therefore, warrants a nuanced analysis, blending quantitative assessment with historical lessons.

The Evolution of Inflation Expectations

Over the past decade, inflation expectations have fluctuated, influenced by technological innovations, globalization, and unconventional monetary policies. Currently, the market perceives inflation as transient but risks becoming ingrained if supply chain disruptions persist or wage growth accelerates unexpectedly. Recognizing these dynamics helps investors and policymakers tailor their responses to current CPI trends.

Key Points

- Understanding the nuanced composition of CPI enhances interpretation of inflation signals.

- Market reactions to CPI data are complex, heavily dependent on context and expectations.

- Broader economic consequences hinge on whether inflation remains within targeted ranges or breaches them significantly.

- Historical patterns provide a lens for assessing current risks and opportunities.

- Policymakers face a delicate balancing act; market data like CPI can accelerate or delay policy shifts.

How accurate are CPI projections in predicting market movements?

+The accuracy varies; CPI is a leading indicator but must be interpreted alongside other metrics such as PPI, employment data, and global trends. Its predictive power is strongest when expectations are embedded into market prices, but unexpected deviations can trigger swings.

What are the long-term implications of sustained inflation above 3%?

+Extended inflation can erode savings, distort investment, and force central banks to adopt more aggressive tightening, risking economic slowdown. It also impacts wage-price spirals and international competitiveness.

Can CPI data influence fiscal policy decisions?

+While CPI primarily impacts monetary policy, sustained inflation readings can prompt government actions such as adjusting taxes, adjusting social benefit indices, or implementing targeted subsidies to mitigate inflation’s effects on households.