Navigating the complex landscape of tax software releases can feel daunting, especially as the IRS continually updates policies and filing requirements. The release date of TurboTax 2024 emerges as a critical juncture not merely for tech enthusiasts but for countless taxpayers who depend on timely, accurate, and user-friendly tools to fulfill their fiscal responsibilities. Understanding why this release date holds significance extends beyond marketing calendars; it influences compliance, financial planning, and peace of mind for millions.

Understanding the Significance of TurboTax 2024’s Release Date in the Tax Ecosystem

At the heart of tax filing workflows, the release date of TurboTax 2024 marks the beginning of a structured preparation period that can impact accuracy and compliance. Taxpayers, whether individual filers with straightforward returns or complex business owners, rely heavily on the software’s availability to ensure they meet the April deadline, while also leveraging new features, updates, and security improvements. The timeline set by Intuit, the parent company, reflects broader industry trends, technological advancements, and regulatory adjustments—each intertwined to shape a seamless user experience.

Timeliness and Compliance: Why Early Access Matters

Tax laws evolve annually, with legislative bodies introducing adjustments to deductions, credits, and reporting requirements. When TurboTax 2024 launches early in the season, users are empowered to adapt their strategies immediately, minimizing the risk of penalties and missed opportunities. Early access enables taxpayers to gather necessary documentation, utilize updated tax law interpretations, and validate their entries against the latest IRS directives. This proactive approach can be particularly beneficial for self-employed individuals, freelancers, and small businesses, who often face complex filings that demand precise adherence to new codes.

| Relevance of Release Date | Impact on Tax Payers |

|---|---|

| Early Access to New Features | Facilitates better planning and deduction optimization |

| Alignment with IRS Deadline | Prevents last-minute rushes, minor errors, and penalties |

| Security and Data Integrity | Ensures updates fix vulnerabilities before filing season peaks |

| Regulatory Compliance | Provides tools reflecting latest tax law changes, avoiding non-compliance |

The Evolution of TurboTax Releases and Industry Expectations

Historically, TurboTax has aimed to release updates in late fall or early winter, aligning with the IRS’s annual deadline for tax law updates and the start of the tax season. This strategic timing isn’t arbitrary; it stems from rigorous developmental cycles, beta testing phases, and regulatory review periods. As digital tax filing becomes more sophisticated, including features like AI-assisted deductions and enhanced security protocols, the importance of a timely release date escalates.

Schedule Synchronization with IRS Announcements and Policy Changes

The IRS typically releases new forms, instructions, and thresholds between late summer and early fall, pushing software providers to incorporate these updates promptly. TurboTax’s release calendar must synchronize seamlessly with these announcements; delays can cascade into user inconvenience, reduced trust, or even non-compliance. When the 2024 version hits the market at the optimal moment, it signals readiness—allowing users to trust the software’s current state and ensuring smooth processing of their returns.

| Key Milestones | Timeline |

|---|---|

| IRS Form and Instruction Release | August – September |

| Beta Testing & Feedback Loop | October – November |

| Official Software Release | Late November – Early December |

| Extended Support & Updates | January – April |

What Late or Delayed Releases Could Mean for Tax Filers

Timing isn’t just a matter of convenience—it can directly influence financial outcomes. A delayed TurboTax 2024 release risks placing users at a disadvantage, especially those who prepare their taxes close to the deadline. This compression could lead to rushed filings, overlooked deductions, or errors that trigger delays or penalties. Conversely, early or on-schedule releases tend to drive better accuracy, thorough understanding of new features, and overall smoother experience.

Potential Risks and Challenges of Missed Release Windows

When a software update encounters unforeseen delays—be it due to regulatory changes or technical hurdles—the repercussions ripple through the user community. For instance, if a new tax credit introduced in early 2024 isn’t supported due to late updates, taxpayers might need to wait or resort to manual calculations, risking errors or missing opportunities. Additionally, security patches that combat emerging malware or data breaches are critical before the filing season begins; an untimely release leaves users vulnerable.

| Risks of Delayed Release | Possible Consequences |

|---|---|

| Non-Inclusion of the Latest Tax Laws | Incorrect filings, penalties, audit risk |

| Security Vulnerabilities | Data breaches, identity theft |

| Reduced User Confidence | Switching to less reliable alternatives |

| Financial Penalties | Missed deductions, late filing fees |

Practical Recommendations for Taxpayers Concerning TurboTax 2024’s Release

Taxpayers eager to optimize their filing process should consider several strategic steps aligned with the anticipated release schedule. Owning the latest version usually means benefiting from current features, security updates, and compliance tools, thus reducing the stress and uncertainty associated with last-minute preparations. Ensuring readiness involves monitoring official channels for release announcements, verifying software updates, and planning accordingly.

Pre-Release Preparation Strategies

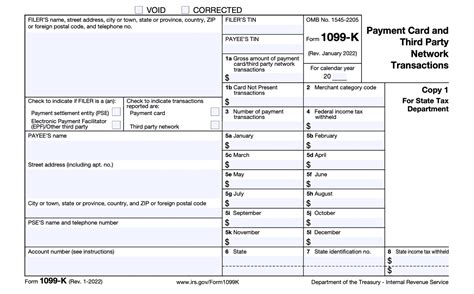

Gather all necessary documentation early—W-2s, 1099s, receipts, and prior-year returns. Setting calendar reminders for the anticipated launch period prevents last-minute scrambling. Additionally, exploring beta versions or early releases if available can provide early insights into changes—though caution is advised regarding stability and completeness. Ultimately, maintaining a checklist tailored to your specific financial situation streamlines the transition once TurboTax 2024 becomes available.

- Follow Intuit’s official communications for release dates.

- Coordinate your documentation review early in the tax season.

- Practice data backup and secure storage of sensitive information.

- Consider feedback from beta testers and early reviews but wait for official stable versions.

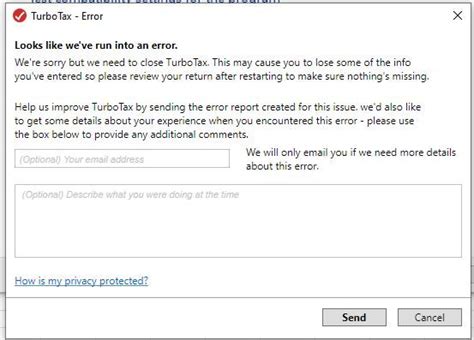

- Plan for support options in case your initial download encounters issues.

Key Points

- Early access to TurboTax 2024 enhances compliance and reduces filing stress.

- Synchronization of release with IRS updates ensures accurate tax law integration.

- Secure software updates mitigate data risks and improve user trust.

- Strategic planning aligns taxpayer readiness with software availability for optimal outcomes.

- Transparent communication from Intuit fosters confidence and minimizes confusion.

Why does the TurboTax 2024 Release Date matter for my taxes?

+Early release means access to the latest features, tax law updates, and security patches, enabling you to file accurately and on time. Delays can lead to rushed filings or missing out on benefits.

What risks are associated with a late TurboTax 2024 release?

+Late releases may cause compliance issues, security vulnerabilities, and increased stress at tax time. Rushed filings risk errors, penalties, or missing deductions, affecting your overall financial health.

How can I prepare for TurboTax 2024’s release to maximize benefits?

+Gather all your tax documents early, stay informed about official release dates, and consider testing early versions cautiously. Preparing in advance helps ensure a smooth transition to the new software and accurate filing.