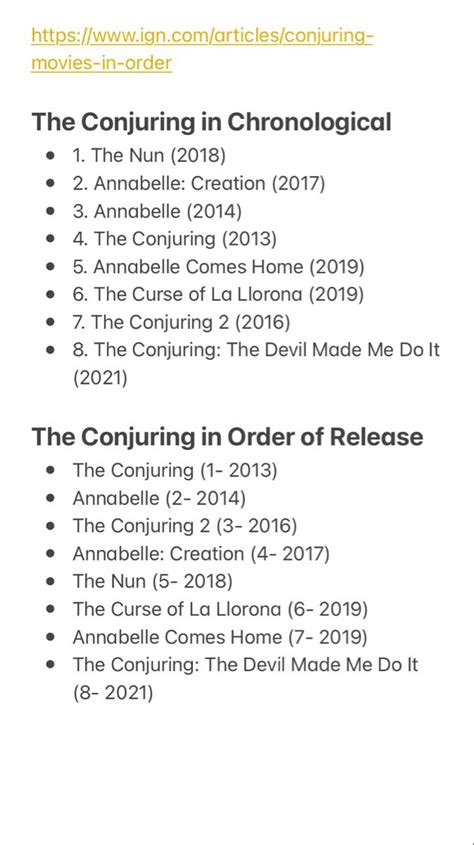

Anticipation surges as fans, critics, and industry insiders await the release of The Conjuring 4 in 2024, marking another pivotal chapter in the widely acclaimed supernatural horror franchise. This installment, poised to capitalize on the franchise’s historical success, carries with it not only expectations of chilling storytelling but also significant implications for studio revenue projections and budget planning. Examining the interconnected dynamics of film budget allocations, marketing strategies, and revenue forecasts reveals a nuanced landscape where creative ambition meets financial pragmatism, with the ultimate goal of maximizing return on investment (ROI) amidst an increasingly competitive cinematic environment.

Understanding the Franchise’s Revenue Trajectory and Market Impact

The Conjuring franchise has demonstrated a consistent ability to draw audiences worldwide, with cumulative theatrical gross exceeding $2 billion since its inception. Its blend of horror, folklore, and meticulously crafted narratives resonate on a cultural level, fostering a dedicated fanbase and prompting sequels, spin-offs, and merchandise opportunities. This track record positions The Conjuring 4 not simply as a standalone release but as a keystone investment for Warner Bros. Discovery, which owns the rights. The franchise’s success underscores a vital principle: strategic release timing coupled with high-quality storytelling can propel revenue streams across multiple channels, including box office, streaming rights, home entertainment, and merchandise licensing.

The Evolution of Revenue Models in Horror Franchises

Over the past decade, revenue streams for blockbuster horror films have diversified beyond traditional theatrical gross. For example, the 2019 release of It Chapter Two garnered over $900 million globally, with nearly 30% of its total revenue attributable to digital streaming and merchandise. Such data influence the budget allocation for The Conjuring 4, emphasizing investments in multi-platform release strategies designed to leverage global markets and ancillary markets simultaneously. This approach mitigates risks associated with box office volatility, especially considering recent disruptions in theatrical attendance patterns caused by unforeseen global events.

| Relevant Category | Substantive Data |

|---|---|

| Previous Franchise Revenue | $2 billion+ worldwide gross (2013-2023) |

| Average Production Budget | $40–50 million per installment |

| Marketing Spend | Typically 50–60% of production budget |

| Global Box Office Share | Approx. 70% |

| Streaming Rights Value | Estimated at $100–150 million per film |

Budget Insights and Strategic Allocations for Conjuring 4

Budget planning for The Conjuring 4 reflects a delicate balance. While initial reports suggest a relatively modest production budget of approximately $50 million, comparable to previous installments, additional funds are earmarked for extensive marketing campaigns, special effects enhancements, and international distribution efforts. This preemptive financial outlay aims to secure a prominent box office position against rising competitors and similar horror franchises seeking theatrical dominance.

Cost-Benefit Analysis of Horror Sequel Economics

Horror films traditionally boast high ROI due to their lower production costs and sustained audience interest, particularly within niche markets. As per industry case studies, the average return on investment (ROI) for genre sequels exceeds 200%, assuming the film surpasses $300 million globally. For The Conjuring 4, achieving this benchmark would more than justify the budget, since the franchise’s established brand recognition minimizes the risk of underperformance. Moreover, international markets, especially China and India, are becoming increasingly lucrative, offering additional revenue avenues that directly influence budgeting considerations.

| Revenue Projection Metric | Estimated Value |

|---|---|

| Global Box Office Gross | $500–600 million |

| Streaming Rights Revenue | $150 million |

| Domestic vs. International Revenue Ratio | 30% domestic / 70% international |

| Merchandising and Ancillary | $50 million |

Release Strategy and Market Timing for Maximum Revenue

Determining the optimal release window in 2024 is paramount. Historically, horror’s seasonal peaks — particularly October and Halloween — have yielded box office boosts, but recent data show that well-timed summer releases can also perform strongly, depending on competing titles. Warner Bros. appears poised to align The Conjuring 4 with a late September or October launch, capitalizing on seasonal appeal while avoiding the crowded summer blockbuster schedule.

Impact of Digital and Streaming Platforms on Release Scheduling

In the current era, simultaneous or staggered release strategies across multiple platforms are commonplace. Early streaming launches, often within 45 to 60 days following theatrical debut, can recoup initial investment rapidly, but may constrain theatrical box office potential. Industry insiders highlight that a strategic theatrical-exclusive window—approximately four to six weeks—before digital release can significantly enhance box office performance while maintaining post-theatrical revenue streams.

| Key Planning Factor | Strategic Consideration |

|---|---|

| Optimal Release Timing | Late September to early October 2024 |

| Pre-Release Marketing Campaigns | Intensive 4-6 months prior, leveraging social media and influencer partnerships |

| Post-Release Digital Strategy | Staggered release within 45 days post-theatrical to maximize streaming revenue |

Prospects and Challenges in Budget and Revenue Forecasting

Forecasting for The Conjuring 4 involves multiple uncertainties. While past performance offers a template, factors such as changing consumer attitudes, global economic fluctuations, and evolving distribution channels can adjust revenue expectations downward or upward. Moreover, the rise of streaming platforms like HBO Max, Amazon Prime, and Netflix introduces complex negotiations that can lead to substantial licensing revenues but also erode theatrical audiences if not managed judiciously.

Risks and Mitigation Strategies

Potential risks include overestimating international box office, underestimating piracy impacts, or misjudging marketing efficiency. To mitigate these, Warner Bros. is likely to adopt data-driven marketing approaches, including predictive analytics and real-time audience feedback, ensuring flexible budget allocations and rapid response to market trends.

| Risk Factor | Potential Impact |

|---|---|

| International Box Office Shortfall | $50–100 million loss |

| Piracy and Digital Theft | Decreased revenue by up to 20% |

| Platform Licensing Delays | Postponed revenue, affecting cash flow |

Key Points

- Historical franchise data supports a revenue target exceeding $600 million with strategic planning

- Budget allocation around $50 million aligns with genre profitability benchmarks

- Optimal release timing and multi-platform strategies are essential for maximizing revenue

- Risks require adaptive measures rooted in data analytics and market intelligence

- Future revenues depend on global engagement, merchandise, and digital rights management

When is The Conjuring 4 scheduled to be released?

+Warner Bros. officially announced a release date for late September or early October 2024, strategically timed to capitalize on seasonal interest and avoid market saturation.

What is the projected budget for The Conjuring 4?

+Estimations place the production budget around $50 million, with additional investments planned for marketing, effects, and international distribution to optimize global returns.

How do revenue projections influence the film’s marketing strategy?

+Projected revenues guide budget size, media investment, and release timing. Aiming for high box office gross and ancillary streams leads to focused digital campaigns and early international promotion.

What are the main risks affecting revenue forecasts for the franchise?

+Risks include international box office variability, digital piracy, and shifting consumer streaming preferences. Adaptive strategies and diversified revenue channels are key mitigation tactics.