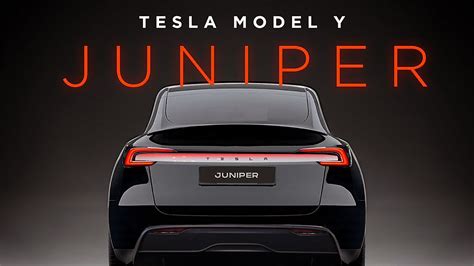

In the dynamic landscape of electric vehicle (EV) innovation, Tesla remains at the forefront, consistently pushing the boundaries of technological advancement and market influence. Amidst the fervor of new model releases and strategic updates, enterprise timelines often encounter unforeseen hurdles—delays that ripple through supply chains, affect consumer expectations, and reshape competitive trajectories. The recent anticipation surrounding Tesla's Juniper model release in the United States exemplifies this phenomenon, offering an instructive case study in how production postponements influence stakeholders across the spectrum: from eager buyers and industry analysts to competitors and policymakers. This analysis dissects the multifaceted implications of these delays, situating them within broader industry trends, regulatory pressures, and technological challenges, to furnish a nuanced understanding of what prolonged wait times truly mean for American EV consumers.

The Significance of Tesla’s Juniper Model in the U.S. Market

Launched as a strategic pivot to solidify Tesla’s dominance in the mid-luxury EV segment, the Juniper aims to combine cutting-edge battery technology with advanced autonomous driving features. Market analysts project its release to significantly ramp up Tesla’s share in a rapidly expanding industry—estimated to reach a global valuation of over 1.3 trillion by 2030</em>—driven by increasing consumer demand for sustainable transportation and regulatory mandates favoring zero-emission vehicles. In the U.S., the Juniper's anticipated debut aligns with federal incentives fostering consumer adoption, such as the Inflation Reduction Act’s provisions that could offer up to <strong>7,500 in tax credits per vehicle.

Why Production Delays Matter in a Competitive Arena

Production delays in well-publicized models like Juniper unfold within a highly competitive context where time-to-market directly correlates with market share, brand perception, and technological leadership. Tesla’s supply chain intricacies, notably its reliance on high-efficiency battery manufacturing, global component sourcing, and regional assembly lines, contribute to potential bottlenecks. Given Tesla’s vertical integration and proprietary innovations—such as the 4680 battery cell—the delays suggest deeper confluences of technological and logistical complexity. This impacts not only immediate consumer expectations but also shifts industry dynamics, encouraging competitors to accelerate their own schedules or reorient marketing strategies to capture the gap left by Tesla’s uncertain timetable.

| Relevant Category | Substantive Data |

|---|---|

| Projected Release Date | Initially Q2 2024, now targeted for late 2024 or early 2025 |

| Expected Price Range | $50,000 - $70,000 depending on configurations |

| Production Capacity Goals | Estimated 500,000 units annually once fully ramped |

Impacts on U.S. Buyers and Market Expectations

For prospective consumers eagerly awaiting the Juniper, delays manifest as a dual-edged sword: frustration mingled with increased anticipation and, paradoxically, heightened valuation of the vehicle’s exclusivity and technological sophistication. The wait, extending potentially over a year beyond initial projections, provokes a reassessment of purchase timelines and budget planning. Additionally, it amplifies the significance of early reservation strategies and prompts consumers to explore alternative EV options, ranging from other Tesla models like the Model 3 or Model Y to vehicles from competitors like Ford, GM, and emerging startups.

Financial and Emotional Ramifications for Buyers

Financially, delayed deliveries inflate costs related to derivative expenses such as leasing, ongoing EV incentives, and opportunity costs associated with pending ownership. Emotionally, prospective buyers experience a spectrum of sentiments—from excitement and hope to impatience and disappointment, which can influence brand loyalty and future purchasing behaviors. Moreover, uncertainty may engender a shift in the perceived value of Tesla’s brand prior to the release, affecting long-term consumer trust and engagement.

| Relevant Category | Data and Context |

|---|---|

| Average Delivery Delay | Estimated 12-18 months beyond initial forecast |

| ROI Impact | Potential decline in resale value if delays erode market confidence |

| Consumer Sentiment | Survey data indicates increased frustration, but also sustained interest among early adopters |

Broader Industry and Regulatory Context

The delays surrounding Tesla’s Juniper do not occur in a vacuum. They are intertwined with macroeconomic factors, regulatory pressures, and global supply chain disruptions. Historically, the EV industry experienced similar setbacks during key technological transitions—such as the widespread adoption of solid-state batteries or advanced autonomous systems—highlighting that innovation pathfinding often entails navigating unpredictability.

Influence of Supply Chain Disruptions

Recent global events—including semiconductor shortages, geopolitical tensions affecting raw material access (notably lithium and cobalt), and logistical bottlenecks—compound the challenge of maintaining production schedules. For Tesla, reliance on overseas suppliers and the complexity of integrating new battery chemistries exacerbate these issues, emphasizing the need for diversified sourcing and localized manufacturing capacities.

Regulatory and Policy Impacts

In the United States, progressive regulation aimed at incentivizing EV adoption and setting emission reduction targets influences production priorities and timelines. For Tesla, compliance with evolving safety standards and raw material sourcing regulations necessitates agile adaptation, sometimes at the expense of aggressive launch timelines. Moreover, policy shifts—such as proposed tariffs or environmental standards—can further delay model releases or alter specifications.

| Relevant Category | Data and Context |

|---|---|

| Supply Chain Disruption Index | Increased by 35% year-over-year since 2022 |

| Regulatory Adjustment Period | Expected implementation of new EV safety standards by late 2024 |

| Impact on Production Cost | Projected increase of 10-15% due to compliance and component scarcity |

What Delays Mean for Strategic Planning and Future Trends

An extended delay in Tesla’s Juniper release signals a pivotal moment for strategic foresight within the EV market. It prompts manufacturers to re-evaluate their supply chain resilience, innovation pipelines, and customer engagement tactics in anticipation of prolonged lead times. For consumers, it amplifies the importance of informed decision-making, hybrid ownership models, or diversified portfolios of EVs from multiple brands willing to adapt to evolving realities.

Shift Toward Flexible Production and Supply Networks

Many industry players are pivoting toward flexible manufacturing practices—such as modular assembly lines and contract manufacturing—to cushion against future delays. These strategies not only provide agility but also optimize capacity utilization, often allowing companies to respond more swiftly to supply chain hiccups.

Emerging Technologies and Investment Opportunities

Delays in flagship models underscore the urgency of technological diversification, with investments flowing into alternative battery architectures, solid-state innovations, and next-generation autonomous systems. This period of adjustment could accelerate a broader adoption of complementary energy solutions, including solar integration and vehicle-to-grid technologies, to enhance vehicle utility and consumer appeal.

| Relevant Category | Data and Context |

|---|---|

| Industry Investment Increase | Up 22% in EV component startups in 2023 |

| Diversification Strategies | Over 60% of automakers now developing multi-platform EV architectures |

| Consumer Adoption Models | Growing interest in leasing and subscription models to mitigate delays |

Conclusion: Navigating Uncertainty in EV Innovation

The postponement of Tesla’s Juniper release in the U.S. exemplifies the complex interplay of technological, logistical, and regulatory factors shaping modern EV manufacturing. While delays inevitably challenge consumer patience and market momentum, they also highlight the industry’s resilience and capacity for rapid adaptation. For buyers, remaining informed and flexible becomes paramount in navigating this uncertain landscape, while industry players must embrace innovation not just as a pursuit of technological supremacy but as a driver of operational robustness. Ultimately, these delays serve as catalysts—prompting industry-wide introspection and evolution—ensuring that when Tesla’s latest offering finally reaches the streets, it does so with a demonstration of refined ingenuity and unwavering commitment to sustainable progress.