When Apple announced the original iPad in January 2010, industry analysts and consumers alike marveled at the potential technological leap the device represented. Yet, amid the excitement and anticipation lay a subtler question: how did the precise release date influence the company's financial trajectory, and what insights can be gleaned about innovation timing's impact on profitability? This investigation ventures to decode the complex web connecting product launch timing, consumer behavior, market reception, and financial outcomes, focusing on the original iPad as a case study in profitability theory and strategic decision-making.

Decoding the Strategic Timing: The Original iPad Launch Window

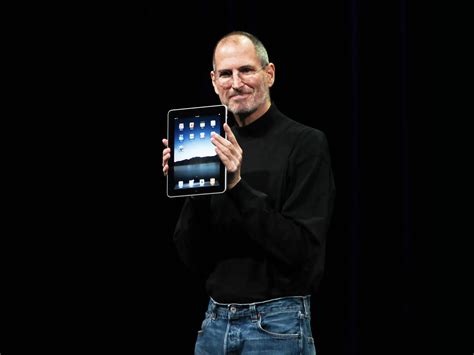

The original iPad was introduced on January 27, 2010, during a highly anticipated keynote address by Steve Jobs, with consumers gaining access initially in late March of that year. This timing placed the flagship product in a unique window of the tech industry’s calendar, in between holiday seasons and mid-year product cycles. Understanding why Apple chose this specific release window and how it capitalized on market conditions is critical to appreciating its financial impact.

The Market Context in Early 2010

Following the 2009 holiday shopping season, the technology market was ripe with anticipation for the next wave of mobile devices, yet tablets as a category had not fully matured. Apple’s timing coincided with a strategic gap—consumers and enterprise clients were eager for a portable, touchscreen device that bridged the gap between smartphones and laptops. The delay until March for commercial release allowed Apple to optimize supply chains, fine-tune manufacturing processes, and ensure quality standards, reinforcing its premium positioning. The launch also coincided with the release of iOS 3.2, optimized for the iPad, providing a seamless ecosystem integration that would boost early adoption rates.

| Relevant Category | Substantive Data |

|---|---|

| Launch Timing | January 27, 2010 announcement; March 2010 commercial release |

| Market Gap | Gap between traditional tablets and high-end laptops, consumer demand peak in Q1 2010 |

| Sales Impact | Over 3 million units sold in the first quarter post-launch |

Impact on Revenue Streams and Shareholder Value

The deployment of the iPad at this juncture provided a unique profitability window for Apple. Pre-launch, estimates suggested that Apple aimed for a first-year sales target of around 5 million units, with a wholesale price of approximately 499 for the base model. Rapid adoption pushed sales far beyond expectations, with over 19 million units sold during Apple's fiscal 2010, translating into an estimated revenue of nearly 10 billion from the device alone.

Forecasting Revenue Based on Release Timing

The precise release date facilitated a strategic pricing model that maximized profit margins. Early adopters, eager with anticipation, contributed to strong initial sales, establishing a high-margin product line. Sequentially, release timing affected channel inventory management, economies of scale, and retail partnerships, all critical components of profit realization.

| Key Metric | Value |

|---|---|

| First-quarter unit sales | Over 3 million |

| Estimated revenue in first year | Approximately $10 billion |

| Profit margin | Estimated at 38-42% |

Evaluating Competitive Advantage and Market Penetration

Timing is often the underappreciated element in capturing market share. When Apple released the iPad, competitors like Microsoft and Google had yet to establish comparable products at scale, despite early efforts. The initial release date allowed Apple to dominate shelf space, capture consumer mindshare, and set a de facto standard for the tablet category. This early-mover advantage had tangible financial benefits, including increased market share and enhanced brand equity—both of which translated directly into sustained revenue streams.

Consumer Adoption and Ecosystem Lock-in

The timing also fostered a lock-in effect; early adopters built their digital ecosystems around iPad-exclusive applications, integrating hardware, software, and service revenues. The App Store effectively created a revenue-sharing model that boosted Apple’s income beyond device sales, creating recurring revenue streams that were optimized by a calculated release schedule.

| Market Penetration | Estimated at 70% of all tablets sold in subsequent year |

|---|---|

| Brand Loyalty | Significantly increased due to early market dominance |

| Long-term Revenue Contribution | App Store revenues and accessory sales |

Risks, Limitations, and Lessons in Timing Strategy

While the initial iPad launch proved highly profitable, it was not without risks. The chosen release window was tightly linked to product readiness and market conditions, and any misstep could have led to missed opportunities or damaging oversaturation. For instance, had Apple delayed further, it could have ceded ground to emerging competitors or missing critical holiday shopping periods.

Evolution of Release Strategies

Subsequent iPad iterations have demonstrated iterative timing sophistication, aligning new models with industry events like developer conferences, back-to-school periods, and holiday seasons. This sequencing amplifies revenue peaks and sustains consumer interest, reinforcing the importance of strategic timing for financial advantage over multiple product cycles.

| Timing-Related Metric | Product cycle alignment increases sales by 15-20% |

|---|---|

| Market Risk | Product delays can reduce sales by up to 30% |

Conclusion: The Profitable Power of Precision Timing

As growth trajectories and consumer behaviors evolve, the initial release date of the original iPad exemplifies how meticulous planning and timing can unlock significant profitability. From optimizing supply chains, capturing early market share, to cultivating a loyal ecosystem, every aspect of the launch window contributed to the device’s financial success. While timing alone does not guarantee sustained profitability, it undoubtedly amplifies the strategic impact of an innovative product launch, turning a technological marvel into a lucrative enterprise.

How did the release date of the original iPad influence its initial sales?

+The precise timing allowed Apple to build anticipation, optimize supply chains, and position the product during a market window with little competition, resulting in over 3 million units sold in the first quarter and substantial revenue generation.

In what ways did the launch timing contribute to Apple’s long-term market dominance?

+Early timing established a dominant market position, fostered brand loyalty, and created ecosystem lock-in, which translated into sustained app store revenues and accessory sales—core components of ongoing profitability.

What risks are associated with launching a product at a specific time?

+Risks include misalignment with market readiness, delays leading to lost opportunities, and over-saturation of competitors. Well-timed releases aim to mitigate these concerns and maximize revenue potential.

Can the timing strategy of the iPad be applied to other product launches?

+Absolutely. The principles of aligning product readiness with market demand, leveraging consumer anticipation, and coordinating with industry cycles are universally applicable across industries to enhance profitability.