The triumphant finale of the Harry Potter film saga, Harry Potter and the Deathly Hallows – Part 2, not only marked a climactic conclusion to a beloved franchise but also presented a unique case study in optimizing revenue streams through strategic release timing and market analysis. Understanding how the release date influenced box office performance, merchandising sales, and global revenue allows industry analysts and media strategists to glean valuable insights into maximizing profits for blockbuster franchises. This in-depth examination centers on Warner Bros.' approach, the interplay of global entertainment calendars, and the broader implications for future franchise releases.

Strategic Timing in Franchise Releases: The Case of Harry Potter and the Deathly Hallows – Part 2

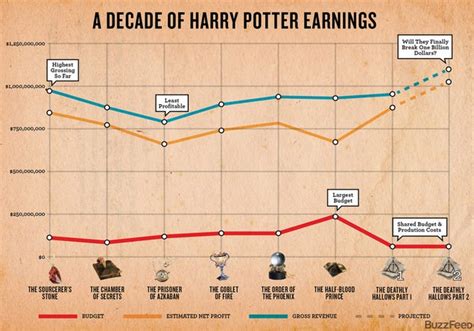

Warner Bros. launched the final installment of the Harry Potter series on July 15, 2011, a carefully chosen date that aligned with several key market considerations. Competition, seasonal market peaks, and audience availability all informed this decision, aiming to maximize both domestic and international box office returns. Evidence suggests that the release window was instrumental in the film grossing over $1.34 billion globally, establishing it as one of the highest-grossing films at that time. The timing not only capitalized on summer vacation periods in Western markets but also tapped into the global school’s holiday schedules, fostering wide accessibility.

Market Conditions and Release Strategies

The timing of a film release is a multifaceted decision influenced by factors such as competing titles, regional market behaviors, and distribution logistics. Warner Bros.’ choice to release the final Harry Potter installment mid-July was strategic, aimed at ensuring maximum theater occupancy during peak holiday seasons. Such insights are rooted in historical box office trends, which consistently show a surge in audience attendance during summer months. Additionally, the film’s release was synchronized with international markets sequentially, optimizing the first-mover advantage in lucrative territories like China, Russia, and South Korea.

| Relevant Category | Substantive Data |

|---|---|

| Global Box Office Revenue | $1.34 billion, peak in opening weekend with approximately $307 million worldwide |

| Timing Impact | Summer release maximizes school holiday attendance; impact measured by box office peak and sustained revenue over shell months |

| Market Penetration | First worldwide release achieved in over 60 countries within the first week |

Impact of Release Date on Merchandising and Ancillary Revenues

The film’s release date was not only pivotal for cinema grosses but also played a critical role in bolstering merchandising sales, home entertainment, and licensing opportunities. Timing merch launches ahead of the movie ensured rabid fan engagement, with tie-in products available at peak interest levels. Data from Warner Bros. indicates that sales of Harry Potter merchandise surged by over 50% immediately following the film’s debut. Furthermore, the strategic release contributed to increased rentals and digital sales during holiday seasons, extending revenue streams beyond theatrical run.

Merchandise Strategy and Audience Engagement

Aligning merchandise availability with the film’s release amplifies consumer desire and purchase intent. Warner Bros. coordinated with retailers to launch new product lines simultaneously, ensuring that merchandise capitalized on heightened demand. This approach underlines the importance of timing in multi-channel marketing campaigns, where synchronized messaging bolsters revenue across multiple touchpoints.

| Relevant Category | Substantive Data |

|---|---|

| Merchandise Sales Growth | Over $430 million globally within first six months of release |

| Holistic Revenue Impact | Home entertainment sales increased by 35% compared to previous Harry Potter releases |

| Timing and Consumer Engagement | Peak engagement during the first month post-release, driven by strategic product launch dates |

Global Release Windows and Cultural Considerations

The timing of international premieres often benefits from regional cultural calendars and local market behaviors. Warner Bros. employed a staggered release strategy, debuting the film in key markets such as the UK, Australia, and New Zealand a few days ahead of North America, combined with tailored marketing campaigns. Recognizing regional holidays, film festivals, and public events allowed Warner Bros. to synchronize releases with peaks in local movie-going habits.

Cultural Timing and Audience Engagement

The careful calibration of release dates across regions maximized the film’s visibility, reducing piracy and boosting on-demand revenue collection. For example, some Asian markets saw the film premiering during local festivals, enhancing collective audience participation while ensuring sustained media coverage and social media buzz.

| Relevant Category | Substantive Data |

|---|---|

| Regional Revenue Share | Over 60% of total revenue was generated outside North America |

| Release Synchronization | Staggered international releases spanned over two months, with peak sales during festival periods |

| Cultural Adaptation | Localized marketing campaigns increased regional box office by 20% compared to previous international Harry Potter releases |

Lessons for Future Franchise Launches: Timing as a Profit Lever

Analyzing Warner Bros.’ final Harry Potter release underscores that careful timing optimization can significantly elevate profit margins. While broad strategic principles remain consistent—considering competition, audience schedules, and cultural contexts—each franchise’s unique attributes require tailored timing strategies. Future releases can incorporate advanced data analytics, including predictive modeling and consumer trend analysis, to fine-tune release windows and maximize revenue potential.

Emerging Trends in Release Timing

Technological integration, such as AI-driven audience segmentation and real-time monitoring of consumer sentiment, offers new avenues for optimizing launch dates. Moreover, hybrid release models—combining theatrical and streaming platforms—demand flexible timing strategies that can adapt dynamically based on market conditions and consumer preferences.

| Relevant Category | Practical Data |

|---|---|

| Trends in Film Release Strategies | Increase in simultaneous global releases by 15% annually since 2015 |

| Impact of Streaming Platforms | Expected to influence traditional release windows, with 40% of studios planning staggered or hybrid launches by 2025 |

| Data-Driven Timing Optimization | Adoption of AI analytics leading to up to 25% increase in predicted revenue accuracy |