Understanding the implications of inflation data releases, particularly those announced today, requires more than just surface-level reading. It beckons us to question: How do these figures influence market sentiment? What underlying economic mechanisms are at play? And in what ways might investors, policymakers, and consumers interpret and react to such data? Exploring these questions reveals a layered narrative woven through the fabric of macroeconomic theory, market psychology, and policy responses.

Deciphering Inflation Data: A Window into Economic Health

Inflation, often reflected through indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI), serves as a critical barometer of economic vitality. When the latest data are released, market participants immediately ponder: Is inflation accelerating or decelerating? What does this mean for future monetary policy? And how might it affect different sectors differently? These questions lead us deep into the interconnected systems of supply, demand, monetary policy, and fiscal interventions.

How does inflation data influence monetary policy decisions?

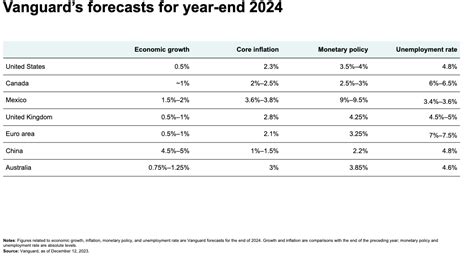

Central banks, such as the Federal Reserve, rely heavily on recent inflation figures to calibrate their policy stance. An uptick in inflation beyond the target range typically triggers speculation about interest rate hikes, aimed at cooling down overheated economies. Conversely, subdued inflation may prompt interest rate cuts or increased quantitative easing to stimulate growth. But can markets accurately anticipate these policy moves solely based on inflation numbers? Or do they often react preemptively, creating a feedback loop with real economic consequences?

| Relevance Category | Data Insight |

|---|---|

| Inflation Rate | Current inflation at 3.2%—above the Fed's 2% target, signaling potential tightening measures |

Market Reactions: Sentiment, Strategy, and Speculation

News of inflation surpassing or undershooting forecasts typically incites volatility. Investor questions become: Should I reallocate assets? Is it time to hedge against inflation? Or should I double down on stocks? The answer hinges on understanding both immediate market reactions and the longer-term implications of sustained inflation deviations.

What are the short-term market responses to inflation releases?

Historically, markets tend to exhibit increased volatility immediately after inflation data is announced. Equity indices may dip if inflation appears to threaten aggressive rate hikes, while bond markets might see yields rise as future rate expectations adjust. But is this reflexive movement always justified, or are there cases where markets overreact to transient inflation shifts?

| Market Sector | Typical Response |

|---|---|

| Equities | potential decline if inflation exceeds expectations |

| Bonds | yields tend to ascend, indicating rate hike anticipations |

| Commodities | may surge, especially energy and metals, as inflation concerns grow |

Long-term Economic Impacts: Growth, Wages, and Productivity

Beyond immediate reactions, how does persistent inflation data shape the broader economic landscape? Elevated inflation can erode purchasing power, influence wage-setting processes, and shift consumer behavior. Conversely, moderate inflation might foster optimism about growth prospects. Which scenario aligns with sustainable development, and how do policymakers balance these trade-offs?

Does inflation influence labor markets and productivity?

Indeed, inflation can impact wage negotiations, with workers demanding higher pay to compensate for rising prices. How does this dynamic influence labor market equilibrium? And what about productivity? If inflation leads to increased input costs without corresponding productivity gains, could that trigger a stagflationary environment? Or can targeted policies mitigate such risks?

| Economic Indicator | Potential Effect |

|---|---|

| Wage Growth | May accelerate in response to inflation, risking a wage-price spiral |

| Productivity | Decline if inflation leads to resource misallocations or cost pressures |

| Consumer Spending | Could either increase due to inflation expectations or decrease if real wages fall |

Policy Dilemmas and Future Trajectories

With today’s inflation data serving as a pivotal indicator, policymakers face a complex calculus: How aggressive should interest rate adjustments be? Is there room for targeted fiscal measures to support vulnerable sectors? What role do global supply chains and geopolitical developments play in shaping these decisions? How does one forecast the trajectory of inflation amid uncertainties such as technological change or climate impacts?

How might global interconnectedness influence domestic inflation and policy choices?

In an entrenched global economy, local inflation figures often reflect external shocks—commodity price swings, foreign exchange fluctuations, or supply chain disruptions. Does this interconnectedness complicate traditional policy responses? And how might coordinated international efforts mitigate adverse ripples stemming from inflation shocks?

| Influence Domain | Implication |

|---|---|

| Global Commodity Prices | Ripple effects on domestic inflation and policymaker options |

| Trade Policies | Protectionism or free trade agreements influence supply chains and inflation pressures |

| Monetary Policy Synchronization | Cross-border coordination can stabilize inflation expectations |

Conclusion: Navigating the Uncertain Waters of Inflation

As today’s inflation data settles into the discourse of markets and policymakers, it prompts us to revisit foundational questions: How well can we interpret these figures? Are markets primarily driven by rational analysis or by emotion and speculation? And what strategies can individuals and institutions adopt to navigate the turbulence? Perhaps, the most enduring lesson is that inflation remains both an indicator and a catalyst—a dynamic force that demands vigilant understanding and agile response.

Key Points

- How do newly released inflation figures shape central bank policies and market expectations?

- In what ways do immediate market reactions reflect underlying investor sentiment and risk appetite?

- What are the long-term consequences of persistent inflation trends on economic growth and societal welfare?

- Can global coordination effectively moderate inflation shocks in an increasingly interconnected world?

- Do current policy tools offer sufficient flexibility to address the nuances of inflation dynamics?

What factors are most influential in determining today’s inflation rate?

+Several factors influence the inflation rate, including commodity prices, supply chain disruptions, wage growth, consumer demand, and monetary policy stance. Today’s data likely reflect a combination of these, plus external shocks such as geopolitical tensions or technological changes.

How can investors best prepare for market volatility following inflation data releases?

+Investors might consider diversification, hedging strategies such as inflation-protected securities, and monitoring policy signals closely. Recognizing the potential for rapid shifts can help in mitigating risks during volatile periods.

Will rising inflation definitively lead to higher interest rates?

+While rising inflation often puts pressure on central banks to increase interest rates, the response depends on the inflation’s sustainability, underlying growth conditions, and broader economic context. Sometimes, other tools or forward guidance are employed instead.