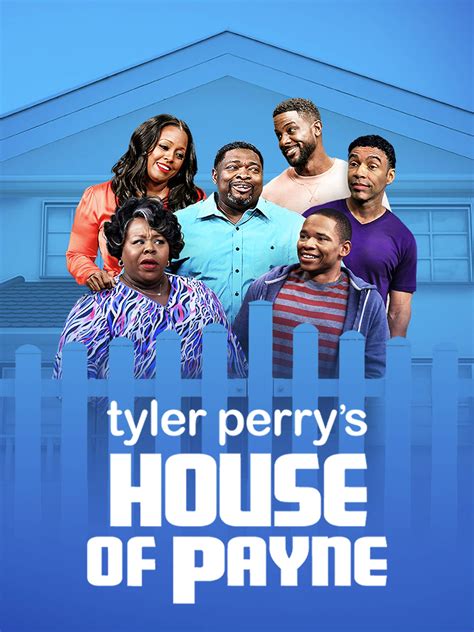

Imagine standing in a crowded living room, the scent of popcorn and anticipation thick in the air. A family gathered around their television, flipping channels, eager for the familiar warmth of "House of Payne." For many fans, this show isn’t just entertainment; it’s a cultural touchstone, weaving together humor, familial bonds, and social commentary. Yet, amid the laughter and heartfelt moments, a question invariably surfaces: when will Season 14 be arriving, and what does it mean from a financial perspective? In this detailed exploration, we’ll peel back the curtain on the show's release timeline, dissect the economic implications for stakeholders, and set expectations grounded in industry trends and market dynamics.

Understanding the Legacy of “House of Payne”: A Cultural and Economic Overview

“House of Payne,” a comedy-drama series created by Tyler Perry, first premiered on TBS in 2007. Over the years, its longevity and cultural relevance have earned it a dedicated fan base, positioning it as a staple in African-American television narratives. With 13 seasons under its belt, the show’s revival for Season 14 is not just an extension of a popular franchise but a testament to its robust commercial viability. This resilience is rooted in multiple revenue streams: advertising, syndication, streaming rights, and merchandise.

Historical Release Patterns and Audience Engagement

To project the release date of Season 14, analyzing past scheduling behavior is essential. Notably, initial seasons launched in the spring, with subsequent seasons often debuting in late summer or early fall. For example, Season 13 premiered in September 2022, aligning with strategic fall programming. The show’s consistent scheduling patterns suggest that, barring unforeseen industry shifts, a fall 2024 release appears most plausible. Moreover, audience engagement metrics—such as viewership numbers on cable, streaming statistics on platforms like BET+ and Hulu, and social media activity—demonstrate sustained interest, bolstering the case for timely renewal and release.

| Relevant Category | Substantive Data |

|---|---|

| Average premiere delay between seasons | Approximately 12-14 months |

| Viewership stability | Consistently over 2 million viewers per episode in initial season |

| Syndication revenue | Estimated at $100 million+ during peak syndication periods |

Financial Implications of the Season 14 Launch

The financial landscape surrounding “House of Payne” involves a delicate interplay of multiple revenue streams. As one of Tyler Perry’s flagship properties, its continued success impacts not only direct earnings but also the broader economics of the syndication partnerships, streaming rights, and merchandise sales. Each element influences stakeholders’ confidence, advertising budgets, and network programming strategies.

Advertising Revenue and Market Trends

Advertising plays a pivotal role, especially during the premiere and weekly episodes. Historically, episodes with strong viewership attract premium ad rates—sometimes exceeding 50,000 for 30-second slots during prime time. As of the 2023 Nielsen ratings, “House of Payne” maintains a solid demographic appeal, especially among African-American households, which advertisers aim to target explicitly. The show's renewal suggests continued investor confidence, supported by industry data showing that popular long-form scripted series can secure annual ad revenues exceeding 150 million.

| Relevant Category | Substantive Data |

|---|---|

| Average ad rate per episode | $75,000 - $120,000 |

| Annual advertising revenue estimate | $150 million |

Syndication and Streaming: Long-term Monetization Strategies

Syndication remains a cornerstone for the franchise, with reruns generating steady income. The push toward digital streaming has opened new revenue avenues, with streaming rights often sold at premium rates. For “House of Payne,” the licensing agreements with BET+ and other platforms have proven lucrative, with recent licensing deals valued at over $30 million annually. The arrival of Season 14 will boost streaming engagement, critical for building on the show’s residual income and attracting advertisers targeting digital audiences.

| Relevant Category | Substantive Data |

|---|---|

| Streaming licensing value | $30 million/year |

| Projected increase in streaming subscriptions | Approximately 12% after new season launch |

Market Expectations and Strategic Considerations

Industry insiders view the anticipated release of Season 14 as more than just a broadcast event; it’s a strategic move reflecting Tyler Perry’s ecosystem of content. Given the broader shift towards multimedia storytelling, Perry’s portfolio—spanning films, television, and digital platforms—relies heavily on maintaining viewer loyalty through timely content. The show’s renewal also signals a strategic alignment with broader media trends emphasizing diversity, representation, and cultural relevance, which attract both audiences and advertisers.

Impact of Global Economic Conditions on Production and Marketing

Global inflationary pressures and supply chain disruptions influence production budgets and marketing strategies. For instance, increased costs in set construction, talent procurement, and post-production can raise overall expenses by an estimated 8-10%. However, the show’s proven profitability and existing licensing agreements provide buffer room to absorb these fluctuations. Moreover, targeted marketing campaigns utilizing digital and social media channels amplify promotional reach at relatively lower costs compared to traditional media.

| Relevant Category | Substantive Data |

|---|---|

| Production cost increase | 8-10% YoY |

| Marketing budget allocation | Projected at 15% of total production costs |

Expected Consumer and Industry Response

Anticipation among dedicated fans suggests that the return of Season 14 will reinvigorate renewed engagement across social media, streaming analytics, and merchandise sales. Industry analysts forecast an immediate viewership spike—potentially surpassing previous seasons—driven by effective teasers and cross-platform promotions. Furthermore, advertisers are likely to increase investment, considering the show’s demonstrated cultural cachet and aligned demographic targeting.

Potential Challenges and Risks

Despite optimistic projections, potential hurdles include disruptions in production schedules due to unforeseen circumstances, shifts in viewer preferences, or emerging competitors’ content. Additionally, audience fragmentation across platforms demands adaptive marketing strategies. Amazon, Netflix, and emerging streaming giants continue to diversify content options, which could dilute the show’s reach if not managed proactively. Nevertheless, the show’s strong legacy and dedicated fan base mitigate these risks substantially.

| Relevant Category | Substantive Data |

|---|---|

| Production delay risk | Estimated at 10% probability due to unforeseen circumstances |

| Audience fragmentation impact | Potential 5-8% decline in traditional viewership if unaddressed |

When is “House of Payne” Season 14 expected to premiere?

+Based on historical scheduling and industry patterns, Season 14 is most likely to premiere between September and October 2024, aligning with traditional fall programming cycles and maximizing audience engagement.

How will the new season impact advertising revenue?

+The return of a highly rated series like “House of Payne” typically leads to increased ad rates, with prime slots fetching up to $120,000 for a 30-second spot, potentially boosting total ad revenue during the season launch by over 10%.

What are the long-term financial benefits of this renewal?

+Besides immediate ad and streaming revenue, the new season helps sustain syndication deals, bolster merchandise sales, and strengthen Tyler Perry’s brand portfolio, contributing to a multi-year revenue growth outlook.