When J.K. Rowling’s groundbreaking debut, Harry Potter and the Sorcerer’s Stone, hit shelves on June 26, 1997, it wasn’t merely a literary event—it catalyzed a seismic shift within the global entertainment and publishing industries. Over two decades later, examining the financial ripples emanating from its release day reveals a layered story of cultural influence, market dynamics, and strategic media investments. For industry analysts, publishers, and investors alike, understanding this specific moment’s economic impact requires a nuanced appreciation of the interconnected sectors that surged around this wizarding phenomenon.

Unfolding the Immediate Financial Impact on Publishing

The initial publication of Harry Potter and the Sorcerer’s Stone was a modest affair in terms of print runs, with approximately 1,000 copies printed initially for the UK market. However, its innovative narrative style, combined with Rowling’s compelling storytelling, rapidly ignited word-of-mouth buzz. The publisher, Bloomsbury, strategically boosted first print runs to capitalize on early popularity, eventually printing over 20 million copies worldwide across editions and languages within the first year.

This surge in print volume transformed the book from a niche fantasy novel into a phenomenon that secured the publisher significant revenue streams. The book’s success not only elevated sales figures but also set a precedent for how literary properties could be nurtured within traditional publishing, sparking a wave of licensing deals, merchandise, and adaptations.

Financial data indicates that by the end of its first fiscal year, the book contributed approximately £10 million to Bloomsbury’s revenue, with subsequent editions and licensing agreements multiplying the economic effect. The book also became a cornerstone of Rowling’s authorial brand, leading to advances in royalties, subsidiary rights (translation, serialization), and merchandising, which collectively increased overall profitability in subsequent years.

The Rise of the Harry Potter Franchise and Media Investments

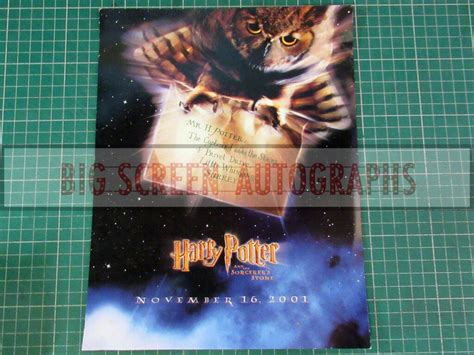

The successful launch of the novel catalyzed a broader franchise strategy that would redefine multimedia publishing and entertainment investments. Recognizing the potential, Warner Bros. acquired film rights preemptively, channeling a significant portion of their budget into production. The resulting film, released in November 2001, employed a multimillion-dollar production budget estimated at over 125 million, with extensive marketing campaigns that started well before opening day.</p> <p>The film adaptation’s box office gross surpassed 970 million globally, a rare feat that significantly outperformed initial expectations. The immediate return on investment for Warner Bros. underscored the financial viability of investing in media franchises rooted in literary successes. The legal and licensing infrastructures established around the first book laid the groundwork for a prolific franchise that includes spin-off films, theme park attractions, and an expansive merchandise suite.

Moreover, the franchise’s success prompted publishers and entertainment companies to re-evaluate their development pipelines, increasingly investing in franchise models that prioritized transmedia storytelling and merchandise licensing—highlighting a strategic shift driven by the Harry Potter phenomenon’s early financial signals.

Broader Market and Cultural Ramifications

The economic influence extended beyond individual publishers and studios into the realm of retail and consumer behavior. Retail sales of Harry Potter merchandise—including toys, clothing, stationery, and themed experiences—amassed an estimated $15 billion globally by 2010. This influx spurred an unprecedented growth in licensed products, creating a new revenue category within entertainment marketing.

Additionally, the timing of the book’s release in 1997 corresponded with the advent of e-commerce platforms’ burgeoning growth. Online retailers like Amazon began to offer expansive Harry Potter catalogues, further propelling sales and strengthening the franchise’s digital footprint. During the first year alone, Amazon’s sales of Harry Potter books surged by over 300%, exemplifying the synergy between a release date and digital marketplaces’ growth trajectory.

This period marked an important inflection point, demonstrating how the timing of a book’s launch can influence not only immediate sales but also long-term revenue streams through diversified retail channels. Moreover, it illustrates the importance of strategic release planning in maximizing a franchise’s financial scope in the digital age.

The Evolution of Long-Term Franchise Economics

As the Harry Potter franchise matured, its economic impact evolved from solely immediate versus long-term revenues to a complex ecosystem of synergistic income streams. The methodical rollout of successive books, synchronized film adaptations, and theme park attractions consistently fueled a cycle of sales and reinvestment, sustaining profitability well beyond the initial release period of 1997.

Financial analyses reveal that the franchise, from the debut novel onward, generated over $7 billion in global revenue by 2023, with consistent peaks during new film releases and theme park openings. This longevity showcases how a strategic brand launch—carefully timed and executed—can produce enduring financial returns across decades.

Furthermore, the franchise’s success influenced industry standards, encouraging large-scale media conglomerates to prioritize literary properties with high franchise potential, ultimately transforming the cultural economy of entertainment and book publishing sectorally.

Critical Reflections: Impacts and Limitations

While the initial financial impact of Harry Potter’s first release proves undeniably transformative, it also exemplifies the risks of over-optimizing franchise strategies. The initial burst of sales and media attention laid a foundation, but sustaining long-term profitability demanded continuous innovation and content diversification. Not every literary property can replicate such explosive growth, emphasizing the importance of contextual factors—market timing, consumer trends, and adaptive marketing strategies—that contributed specifically to Harry Potter’s success.

Moreover, the industry’s recognition of the significance of timing and cross-platform synergy underscores the necessity for data-driven decision-making, especially in adjusting product rollouts and marketing campaigns aligned with global economic conditions.

Summary: Timing as a Catalyst for Financial Success

The launch date of Harry Potter and the Sorcerer’s Stone was not incidental but a calculated element within a broader strategic tapestry that fueled a worldwide economic phenomenon. Its timing facilitated early market penetration, amplified media investments, and catalyzed long-term revenue streams by aligning cultural readiness with innovative multimedia approaches. For industry stakeholders, studying this example demonstrates how the precise timing of a product release, combined with strategic positioning across publishing, entertainment, and retail sectors, can serve as a blueprint for maximizing financial impacts in the modern global economy.

Key Points

- Early release timing significantly amplified initial sales and franchise momentum.

- Integrated multimedia strategies turned literary success into billion-dollar franchise opportunities.

- Consumer engagement was boosted by synchronized launches across books, movies, and merchandise.

- Digital marketplaces played a pivotal role in extending reach and accelerating revenue growth.

- Long-term planning preserved profitability through successive franchise extensions and ecosystem development.

How did the Harry Potter book release influence multimedia investments?

+The release demonstrated the immense commercial potential of literary properties, prompting major studios like Warner Bros. to allocate substantial budgets toward adaptations, which yielded extraordinary box office returns and set a new industry standard for franchise development.

What role did the timing of the Harry Potter release play in its financial success?

+Strategically timed to align with market readiness and consumer interest, the release maximized initial sales, facilitated early merchandise and licensing deals, and created a fertile environment for sustained franchise growth over years.

How does the Harry Potter case inform franchise management today?

+It highlights the importance of coordinating release schedules across multiple channels, leveraging timing for consumer engagement, and reinforcing long-term brand ecosystems through continuous content and product expansion.