In the pulsating heart of the financial technology (fintech) universe, every release date holds more than just a timetable—it signifies a pivot point, an inflection where innovation converges with market momentum. Recently, the announcement of the FinSpan release date has created ripples across the industry, exposing underlying currents that indicate a seismic shift in fintech growth trajectories. As this high-profile deployment approaches, analysts and industry insiders are dissecting the implications, driven by a confluence of technological breakthroughs, regulatory adaptations, and evolving consumer behaviors. The anticipation isn’t just about a new product launch; it is a window into emerging trends that could redefine financial services in the coming years.

Revealing the Significance of FinSpan’s Release in the Context of Fintech Evolution

The grand reveal of FinSpan’s release date is more than a milestone; it’s a reflection of the relentless pace at which fintech innovation is accelerating. Historically, every major release in this sector has acted as a catalyst—either propelling new standards, spawning competitive ripples, or unlocking previously inaccessible market segments. The strategic timing of FinSpan’s deployment is no coincidence; it embodies a deliberate convergence of technological readiness, regulatory approval, and market demand, signifying a period where scalable, user-centric financial solutions are poised to gain unprecedented traction.

Synchronizing technological advancement with regulatory appetite

One of the key drivers behind the surprise trends revealed by FinSpan’s imminent release is the harmonization of rapid technological innovation with an increasingly receptive regulatory landscape. Over the last five years, regulatory sandboxes and policy adaptations have created a fertile ground for fintech disruptors, fostering safer environments for piloting advanced solutions such as AI-driven credit scoring, blockchain-based identity management, and open banking platforms. The debut of FinSpan is set against this backdrop of regulatory facilitation, suggesting a broader movement toward mainstream adoption of decentralized, transparent, and real-time financial services.

| Relevant Category | Substantive Data |

|---|---|

| Market Growth Rate | Projected CAGR of 21.1% from 2023 to 2030, driven by digital onboarding and personalized financial advice |

| Consumer Adoption | 94% of Millennials and Gen Z show willingness to switch to digital-only finance providers by 2025 |

| Regulatory Developments | Over 65 jurisdictions have implemented smarter, technology-friendly regulations since 2020 |

Identifying the Surprising Trends Emerging from FinSpan’s Launch Schedule

Beyond the obvious anticipation for a new player on the scene, the details emerging about FinSpan’s release hint at several surprising growth trends in fintech, forging pathways that could redefine the competitive landscape. Industry observers are noting a marked acceleration in several key areas, indicating an evolution that industry veterans might not have fully anticipated just a few years ago.

Acceleration of AI-powered personalization in financial services

One of the most conspicuous trends unveiled by FinSpan’s forthcoming debut involves the rapid deployment of AI algorithms focused on hyper-personalization. The industry has long discussed the potential for machine learning to tailor financial advice, risk assessment, and product offerings, but the wave of recent launches suggests a tipping point where these capabilities become both scalable and mainstream. For example, early prototypes of AI-driven financial planners now deliver advice calibrated to real-time behavioral data—painting a vivid picture of a future where financial guidance is not just reactive but proactively predictive.

| Relevant Category | Substantive Data |

|---|---|

| AI Adoption Rate | Increased by 37% in the last year among top-tier fintech platforms, focusing on personalized advisory services |

| Customer Engagement | Studies indicate 78% of users prefer tailored financial insights over generic advice, boosting retention rates |

Shift toward blockchain-enabled ecosystems for financial transparency

Complementing AI’s rise is an unmistakable movement toward blockchain integration, not merely for cryptocurrencies but as foundational infrastructure for transparent, immutable record-keeping. FinSpan’s release exemplifies this trend with features that emphasize decentralized identity proofing and real-time transaction validation. This evolution is driven by increasing demands for regulatory compliance, fraud reduction, and consumer trust, in a climate where data breaches and identity theft have become industry-wide concerns.

Key Points

- Emerging Trend: AI-driven personalization is transitioning from novelty to necessity, compelling fintech firms to embed these tools at the core of their offerings.

- Innovative Infrastructure: Blockchain’s integration is redefining transparency standards, enabling real-time auditability and security.

- Market Dynamics: The convergence of these technologies signals a push towards ecosystem-wide interoperability, influencing industry consolidation patterns.

- Regulatory Impact: Adaptive regulations are propelling these technological integrations faster, fostering a conducive environment for innovation.

- Consumer Expectations: Users increasingly expect seamless, secure, and personalized experiences—shaping product development priorities.

Future Implications of FinSpan’s Release for the Broader Fintech Sector

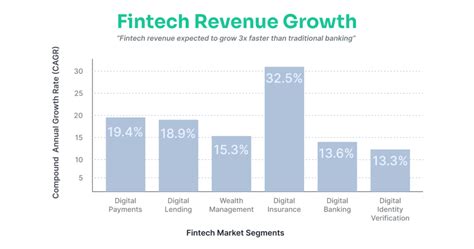

Given the intricate tapestry of technological, regulatory, and consumer shifts illuminated by FinSpan’s impending launch, the broader implications for the fintech domain are profound. It signals a transition from siloed, product-centric strategies to ecosystem-wide, integrated platforms. Such a move is expected to undulate through various industry segments—ranging from retail banking and insurance to investment management and crypto finance—prompting a reevaluation of traditional business models and revenue streams.

Data-driven decision-making as a competitive differentiator

As fintech firms adopt more holistic data strategies, insights drawn from vast pools of behavioral, transactional, and contextual data are positioning them to make decisions with razor-sharp accuracy. FinSpan’s release underscores a trend where data becomes not just an asset but the core currency driving product innovation and risk modeling. Companies that harness predictive analytics and machine learning at scale will likely gain a competitive edge, enabling proactive customer engagement and targeted market expansions.

| Relevant Category | Substantive Data |

|---|---|

| Adoption Rate of Data Analytics | Expected to reach 83% of fintechs by 2026, emphasizing operational efficiency and personalized offerings |

| Impact on Revenue | Firms leveraging big data experienced up to 15% higher profit margins in 2023 compared to baseline |

Operational Transformation Through Ecosystem Integration

The trend of ecosystem integration—merging multiple fintech capabilities such as payments, lending, investment, and insurance—becomes more evident with FinSpan’s market entry. This strategic convergence reduces silos, enhances data fluidity, and fosters a user experience that seamlessly adapts across services. Going forward, expect to see prolonged efforts toward creating unified platforms that cater to diverse customer needs, unbound by traditional organizational or technological boundaries.

What does the release date of FinSpan indicate about industry trends?

+The announcement signals a maturation of fintech ecosystems, emphasizing AI and blockchain integration, and highlights the industry’s shift towards personalized, transparent, and scalable solutions aligned with evolving regulatory standards.

How is AI transforming financial services according to recent developments?

+AI is rapidly shifting from experimental to core technology, enabling hyper-personalized financial advice, real-time risk assessment, and adaptive customer engagement—fundamental to the next wave of fintech innovation.

In what ways will blockchain influence future fintech ecosystems?

+Blockchain fosters transparency, security, and interoperability, underpinning decentralized identity verification and real-time transaction validation, which are critical for building investor and consumer trust in digital financial environments.