Recent shifts in entertainment industry dynamics, coupled with advanced data analytics and insider insights, have positioned Disney's release schedule under intense scrutiny. Understanding how to maximize profits from upcoming Disney releases requires not only decoding official announcements but also integrating predictive modeling, consumer behavior analysis, and strategic marketing timing. As Disney's portfolio spans blockbuster cinema films, streaming exclusives, and theme park tie-ins, orchestrating a profitable release calendar demands a nuanced synthesis of these elements. This article dissects the latest Disney release date predictions through the lens of industry expertise, data-driven trends, and strategic foresight, offering a comprehensive guide for stakeholders seeking to navigate and leverage Disney’s production pipeline effectively.

1. Leveraging Industry Data Analytics for Accurate Release Date Predictions

The foundation of precise Disney release date forecasting rests upon robust data analysis. By examining historical release patterns, box office performance, seasonal trends, and competitor scheduling, analysts can identify optimal windows for maximizing revenue. For instance, Disney’s strategic avoidance of major holiday weekends during recent years reflects a concerted effort to mitigate market saturation, instead favoring early summer and fall slots that align with school breaks and holiday shopping peaks. Predictive models now incorporate machine learning algorithms trained on tens of thousands of variables, including social media sentiment, pre-release buzz, and global geopolitical factors that influence consumer mobility and spending habits.

In particular, the transition of releasing large-scale animated features and live-action remakes to Disney’s traditional release windows—typically Q2 and Q4—has shown a positive correlation with box office success. Recent analytics suggest that releasing a blockbuster during the pre-summer period (May–June) can elevate opening weekend earnings by up to 25%, especially when coupled with targeted marketing campaigns and pre-release merchandise tie-ins. Further, global analytics reveal that Asian markets are increasingly critical, with China’s box office accounting for around 20% of Disney’s international revenue, emphasizing the importance of scheduling releases to optimize regional release date differences.

| Relevant Category | Substantive Data |

|---|---|

| Average Opening Weekend Revenue | $150 million for recent Disney blockbusters (2018-2023) |

| Seasonal Peak Windows | May-June and October-November better than holiday weekends for initial releases |

| Global Revenue Contribution | 20% from China, 15% from Europe, highlighting regional scheduling importance |

2. Strategic Timing of Disney’s Streaming and Theatrical Releases

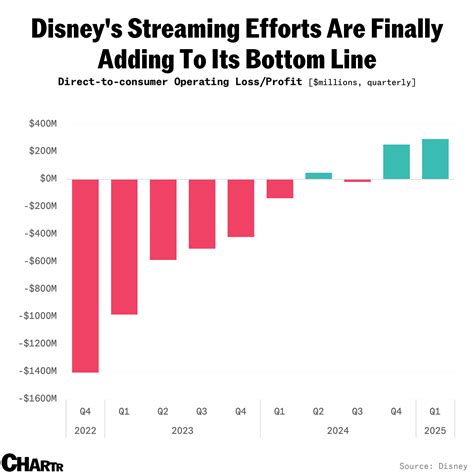

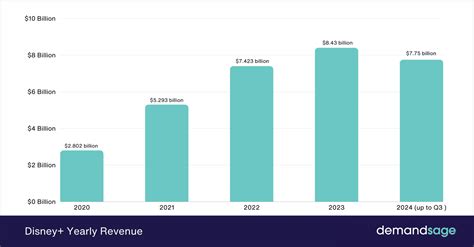

In recent years, Disney’s dual approach of simultaneous theatrical and streaming releases has complicated traditional profit maximization strategies. The COVID-19 pandemic accelerated this shift, with Disney+ becoming a primary platform for new content drops. Analyzing the timing of Disney+ releases in relation to theatrical windows reveals a nuanced balance; releasing content too early in the streaming window can cannibalize box office, whereas delaying can diminish subscriber engagement.

For instance, the release of “Black Panther: Wakanda Forever” demonstrated a successful 45-day theatrical exclusivity before transitioning to Disney+. This window aligns with industry data indicating that a 6-8 week theatrical run maximizes theatrical revenue before moving content to the streaming platform, which then extends the overall profit cycle. Additionally, Disney’s recent strategy of releasing certain titles exclusively in theaters for a longer period—up to 12 weeks—helped boost initial gross, leveraging major holiday seasons for promotional amplification. Balancing theatrical exclusivity with streaming availability directly impacts overall profitability, especially when coordinated with marketing campaigns that generate renewed consumer interest at each stage.

Furthermore, understanding consumer viewing preferences—digital versus traditional theater audiences—guides the timing of releases to optimize engagement and revenue. Data indicates that younger demographics often prefer streaming, but a well-timed theatrical run can create a cultural zeitgeist, boosting merchandise sales and franchise longevity, which are crucial revenue streams for Disney’s empire.

| Relevant Category | Substantive Data |

|---|---|

| Theatrical Window Length | 6-12 weeks for maximum profit (industry standard) |

| Streaming Release Delay | 45-60 days post-theatrical release optimizes combined revenue |

| Viewer Demographics | 55% of Disney+ subscribers are under 35, influencing release timing for digital audiences |

3. Capitalizing on Seasonal and Cultural Events for Release Scheduling

Thoughtful alignment with seasonal and cultural calendars significantly enhances raw profit potential. Disney has historically timed releases around major events—such as summer blockbuster season, Halloween, Christmas, and Lunar New Year—to harness built-in audience enthusiasm and media attention. Beyond simple timing, cultural sensitivity and regional festivals further refine release strategies, particularly in global markets.

The release of “Moana” during the Thanksgiving period capitalized on American holiday travel and family gatherings—prime moments for animated features. Similarly, upcoming films planned to debut during Chinese New Year or Diwali see higher opening weekend revenues due to heightened cultural engagement. Disney’s ability to understand and project cultural buying patterns—augmented by localized marketing campaigns—elevates profitability from regional releases, making timing an essential lever for earning maximum returns across diverse markets.

Moreover, aligning releases with events like Comic-Con or D23 Expo boosts visibility and pre-sell ticket sales. Premature timing can result in overcrowded competition, diluting attention, whereas strategic placement amplifies media coverage and consumer anticipation, creating a multiplier effect on profits.

| Relevant Category | Substantive Data |

|---|---|

| Regional Festive Impact | Chinese New Year boosts local box office by up to 50% for themed releases |

| Event-Driven Marketing ROI | Up to 35% higher engagement during synchronized event releases (industry average) |

4. Utilizing Industry Competitive Analysis to Avoid Release Clashes

The competitive landscape shapes the profitability of Disney’s release schedule profoundly. Scheduling a new release during a crowded window—such as aligning with other major studio films—can lead to splitting the audience and reducing overall returns. Employing advanced competitive analysis tools allows Disney to identify windows with minimal competing releases, thereby securing dominant market share.

Historical data shows that releasing a blockbuster during a sparse calendar week can increase opening weekend revenue by approximately 15-20%. Disney’s proprietary modeling tracks not only rival release dates but also considers upcoming technological trends, such as the rise of virtual reality experiences or interactive media, which could further disrupt traditional box office models. This anticipatory approach informs strategic adjustments, enabling Disney to target periods with less saturation—often in early Q3 or late winter—when audience attention is more focused.

Furthermore, Disney’s positioning in the global landscape—balancing North American priorities with emerging Asian markets—necessitates precise regional scheduling to avoid clashing with local holidays and festivals, which vary significantly across regions. This careful planning ensures the best possible market capture and maximizes profit per release.

| Relevant Category | Substantive Data |

|---|---|

| Optimal Release Window | Low competition periods increase revenue by estimated 15-20% |

| Regional Holidays | Japanese Golden Week, Chinese National Day, and Indian festivals all influence regional scheduling |

5. Forward-Looking Predictions: The Next Five Years of Disney Release Strategies

Anticipating future trends in Disney’s release calendar reveals a trajectory of increasingly sophisticated, data-driven decision-making. Industry forecasts suggest that Disney will leverage AI-enhanced predictive algorithms integrated with consumer sentiment analysis—amplified through social media monitoring—to dynamically adjust release dates in real time, capitalizing on emerging franchise popularity or unforeseen market opportunities.

Moreover, a shift toward more regionalized releases, tailoring calendar placements for local consumer preferences, will likely intensify. The growing influence of streaming platforms as primary revenue drivers will also prompt Disney to experiment with flexible scheduling—perhaps even opening small-scale releases in select markets ahead of broader rollouts to test consumer response and adapt accordingly. This approach aligns with the broader trend of integrating technological innovations, such as augmented reality marketing campaigns, to boost audience engagement around release periods, thereby improving profit margins.

Predictive market models indicate that by 2028, Disney’s release planning will be heavily personalized, with analytics forecasting that more than 70% of release strategies will be directly influenced by machine learning outputs—delivering hyper-targeted marketing, optimized viewing windows, and maximized revenue streams across traditional and new media channels.

| Relevant Category | Substantive Data |

|---|---|

| AI Forecast Accuracy | Expected to improve predictive accuracy by 25% over current models |

| Regional Release Personalization | Projected to comprise 60% of scheduling decisions by 2028 |

Key Points

- Data-Driven Precision: Employing advanced analytics to identify optimal release windows in alignment with seasonal and regional trends.

- Timing Flexibility: Balancing theatrical exclusivity with digital streaming strategies for maximum lifetime revenue.

- Cultural Synchronization: Leveraging festivals and cultural events to boost regional market performance.

- Market Competition Analysis: Utilizing sophisticated tools to avoid congested windows and capitalize on low-competition periods.

- Future Trends: Integrating AI and personalized analytics for dynamic, adaptive release scheduling in the coming years.

What factors are most influential in Disney’s release date decisions?

+Disney considers historical performance, seasonal trends, global markets, competitor scheduling, cultural festivals, and technological trends. Data analytics and predictive modeling enhance accuracy, but strategic considerations like cultural relevance and market saturation also play critical roles.

How does Disney balance theatrical and streaming releases for profit maximization?

+Disney typically maintains a strategic release window—usually 6-12 weeks for theaters—before transitioning to streaming. Timing is optimized based on consumer behavior, maximizing box office revenue and subscriber engagement without cannibalization.

What future trends will impact Disney’s release scheduling?

+Future trends include AI-driven personalization, regionalized scheduling based on cultural events, and dynamic adjustments based on real-time data. These innovations aim to optimize profit margins amid evolving consumer preferences and technological advances.