Imagine waking up to a new batch of economic indicators, each whispering secrets about the state of inflation fears, consumer confidence, and monetary policy trajectories. Today’s CPI data release is more than just numbers; it’s a narrative that shapes investor sentiment, guides policymaker decisions, and influences everyday household planning. But what is it about the Consumer Price Index (CPI) that renders it such a vital barometer? More intriguingly, what insights can we glean from this fresh data to interpret the nuances of inflation’s current path? These are questions that invite both analysis and reflection, pushing us to consider the complex interplays at work in economic measurement and real-world implications.

Understanding the Core of CPI and Its Role in Measuring Inflation

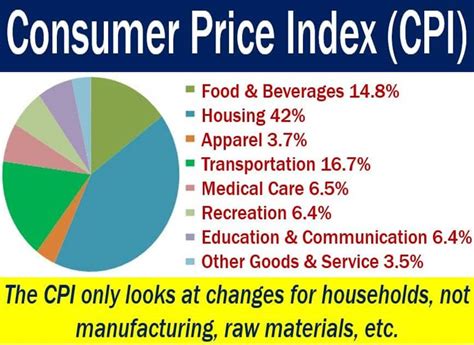

The Consumer Price Index functions as a sentinel metric tracking the average change over time in prices paid by consumers for a market basket of goods and services. It’s both a quantitative and qualitative measure, sprawling across categories like food, energy, housing, and transportation. But why has the CPI remained a central figure in economic discourse globally? Is it because it encapsulates the lived experience of inflation through consumer expenses, or does it serve a more technical purpose within the fabric of macroeconomic policy? Importantly, how does its construction influence interpretability and subsequent policy response?

The Technical Foundation and Its Significance

The CPI is derived from methodologically rigorous data collection, involving monthly surveys from thousands of households and detailed price tracking across a wide array of commodities. Its calculation hinges on weighting the relative importance of each category based on expenditure patterns, which naturally evolve over time. As a result, one might ask: does the CPI truly reflect the evolving cost pressures faced by consumers, or might it lag behind real-time economic shifts? Furthermore, how do seasonal adjustments and substitution biases influence the fidelity of CPI as a real-time inflation gauge?

| Relevant Category | Substantive Data |

|---|---|

| Primary Metric | Year-over-year CPI change at 3.2%, surpassing the Federal Reserve’s 2% target |

| Core CPI (excluding food and energy) | 2.8%, indicating underlying inflationary pressures |

| Energy Prices | 4.9% increase, driven by recent oil price surges |

| Food Prices | 3.5% rise, reflecting supply chain constraints and commodity fluctuations |

Decoding the Recent CPI Release: What Are the Key Takeaways?

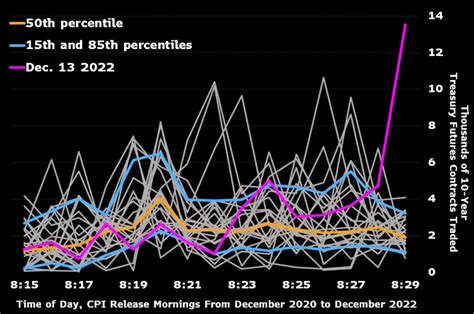

When analysts dissect today’s CPI numbers, the crux often revolves around whether inflation is cooling off or surging anew. The latest release indicating a month-over-month increase of 0.4%—a slight acceleration compared to prior months—raises questions about the durability of current inflation trends. Are we witnessing a transient spike due to seasonal factors or supply chain snarls, or does the data point towards a longer-term shift in inflation dynamics? This distinction is critical because it influences the outlook of central banks, particularly the Federal Reserve, whose policy pivots depend heavily on such signal points.

Impact of Energy and Food Price Volatility

Energy prices, notably, climbed nearly 5%, a significant uptick that can rapidly feed into broader price pressures. Food prices, similarly, edged higher, exacerbating cost-of-living concerns among consumers. What do these sector-specific increases reveal about the transmission mechanisms of inflation? Are they primarily supply-driven or reflective of demand-side exuberance? And how might external geopolitical tensions, such as conflicts in key producing regions, amplify or temper these trends?

Broader Economic Implications of CPI Data

Understanding the implications extends beyond immediate price movements. Rising CPI figures tend to influence monetary policy by prompting central banks to consider tightening measures—interest rate hikes, for example—to temper inflation. Conversely, subdued or declining CPI readings might encourage easing policies to support growth. But is this a linear relationship? Could there be scenarios where a rising CPI leads to further expansionary policies if the underlying inflation is deemed transitory? How do policymakers weigh such complex signals amidst competing economic priorities?

Inflation Expectations and Consumer Behavior

Another dimension is how CPI data shapes inflation expectations among consumers and businesses. Elevated inflation figures can become a self-fulfilling prophecy if they cause wage demands or pricing strategies to escalate. Are current CPI trends intensifying this phenomenon? What does survey data reveal about expectations, and how do those expectations influence actual inflation trajectories?

| Relevant Sector | Current Trend |

|---|---|

| Housing | Persistent rent increases at 4.5% annual pace, fueling core inflation |

| Transport | Car prices up more than 7%, driven by semiconductor shortages |

| Labor Market | Wage growth at 4.0%, surpassing productivity rates, adding inflationary pressure |

Historical Context and Evolution of CPI’s Role in Policy Making

Tracing the lineage of CPI’s influence reveals a century-long journey. From post-World War II stabilization efforts to the stagflation of the 1970s and subsequent inflation targeting regimes, how has the interpretation of CPI data informed policy shifts? Would you agree that the divergence in inflation readings during pivotal moments accentuates the importance of nuanced analysis, rather than reliance on a single metric? What lessons from history remain salient today, especially amid the current globalized economy and digital transformation?

Lessons from Past Inflation Cycles

In the 1980s, Paul Volcker’s aggressive rate hikes were triggered by stubborn inflation, partly driven by CPI signals. Comparing that to recent trends, are policymakers in a similar quandary—balancing inflation risk against growth concerns? How much weight should be placed on CPI versus broader indicators such as inflation expectations, employment data, and financial market signals?

Integrating Alternative Indicators and Data Sources

While CPI remains foundational, what other metrics can complement its insights? Producer Price Index (PPI), Employment Cost Index (ECI), and real-time high-frequency data—how do these enhance our understanding? Is the convergence of signals from multiple data streams more reliable than relying solely on CPI? Could advancements in data analytics and artificial intelligence herald a new era in inflation monitoring?

Incorporating Real-Time Data and Machine Learning

Imagine algorithms that synthesize mobility data, credit card transactions, and supply chain tracker inputs with traditional CPI figures. Would such integrated models improve the timeliness and accuracy of inflation forecast? What are the challenges in ensuring transparency, interpretability, and robustness in these complex systems?

Key Points

- Inflation trends spotlit by CPI are intertwined with global supply chain and geopolitical factors, demanding a multi-dimensional analysis.

- Current CPI data suggests both transitory sector-specific pressures and latent, potentially entrenched inflationary forces.

- Historical lessons underscore the importance of precise interpretation amidst political and economic complexities.

- Advances in data science promise enhanced inflation monitoring, but require careful implementation to avoid misinterpretation.

- Understanding the evolution and limitations of CPI can help policymakers and investors make informed decisions amid uncertainty.

What does the recent CPI data tell us about inflation’s future trajectory?

+It indicates that while some inflationary pressures are subsiding, sector-specific increases—particularly in energy and food—may persist short-term. The broader core inflation suggests underlying momentum, but the trajectory will depend on external factors like supply chain normalization and policy responses.

How reliable is CPI as a measure in current economic conditions?

+CPI remains a vital metric, but it has limitations such as substitution bias and lag in capturing real-time changes. Complementing it with other indicators and high-frequency data can provide a more holistic view of inflation dynamics.

In what ways can policymakers better utilize CPI data?

+Policymakers can incorporate CPI insights into a broader array of indicators—including inflation expectations and market-based measures—to craft more responsive, nuanced monetary policies tailored to evolving economic landscapes.