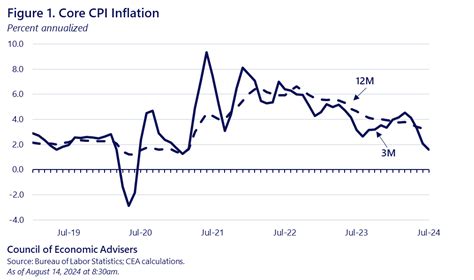

In the intricate dance of economic indicators, the Consumer Price Index (CPI) stands as one of the most anticipated metrics, reflecting the shifting tides of inflation and purchasing power. Each release offers a window into the prevailing economic climate, influencing policies, investment decisions, and consumer confidence. Personal experience has shown me how traders, policymakers, and everyday consumers alike watch these dates with a mix of anticipation and trepidation, knowing that a single CPI report can sway markets or spark debates about the future of monetary policy.

Understanding the Significance of CPI Data and Its Scheduled Release

When I first delved into economic data analysis, I quickly discovered how pivotal CPI figures are not merely numbers but signals that ripple across the financial world. The CPI encapsulates the average change over time in the prices paid by consumers for a market basket of goods and services. Its importance isn’t just academic; it directly influences inflation targeting, wage negotiations, and monetary policy adjustments. Consequently, the timing of its release becomes a focal point for analysts, investors, and policymakers who need to calibrate their strategies based on the latest inflationary signals.

The Typical Schedule for CPI Data Releases

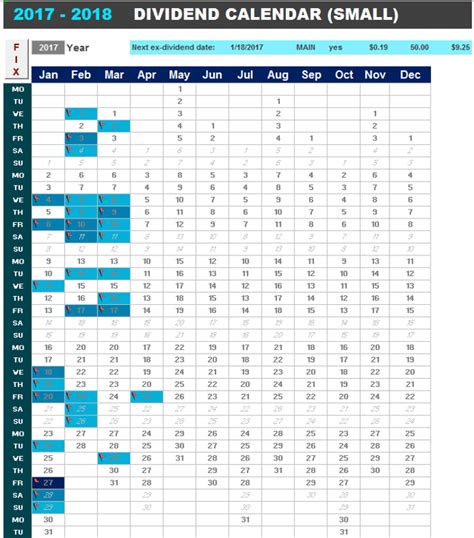

The Bureau of Labor Statistics (BLS), a division of the U.S. Department of Labor, is responsible for releasing CPI data in the United States. Historically, these releases occur on a predictable schedule—generally around the middle of each month—covering data for the previous month. For instance, CPI data for January is usually published in mid-February. This regularity offers market participants the flexibility to incorporate upcoming reports into their investment frameworks, while also preparing for potential volatility post-release.

| Relevant Category | Substantive Data |

|---|---|

| Next CPI Release Date | varies, typically mid-month (e.g., around the 13th to 15th) |

| Historical Average Release Day | 14th listed as common, but can vary slightly |

| Time of Day | Usually around 8:30 a.m. Eastern Time |

Key Points

- Precise Scheduling: CPI data is typically released around the 14th of each month, offering predictability vital for planning.

- Market Impact: The release influences inflation expectations, monetary policy signals, and asset valuations.

- Preparation is Key: Traders and institutions often position themselves ahead of release dates, increasing market volatility around these times.

- Global Considerations: While primarily U.S.-focused, the CPI release has international ripple effects, especially in markets highly integrated with U.S. monetary policy.

- Monitoring Changes: Slight shifts in schedule—due to federal holidays or administrative changes—can occur, making real-time tracking essential for accurate timing.

How to Keep Track of CPI Release Dates and Market Expectations

To maximize the utility of upcoming CPI data, establishing reliable sources for scheduled releases is paramount. I have relied heavily on tools like the Federal Reserve calendars, financial news platforms such as Bloomberg and Reuters, and the BLS’s own calendar, which is updated for any adjustments—such as holiday-related modifications or emergency releases. Since these dates are generally known well in advance, setting reminders and scheduling your trading strategies around them can profoundly influence investment outcomes.

Utilizing Economic Calendars for Better Market Navigation

Economic calendars serve as a compass in the chaotic seas of market movements. They map out scheduled releases, estimate consensus forecasts, and track previous figures, offering a quantitative foundation to frame your expectations. Building habitual checks into daily routine—whether via mobile apps or desktop platforms—can help traders and analysts stay ahead of the curve. Having personally experienced the sudden gyrations triggered by CPI deviations from forecasts, I’ve come to understand that even the best predictions don’t always capture underlying surprises—thus, flexibility remains essential.

| Relevant Metric | Value/Forecast |

|---|---|

| Consensus CPI Increase (YoY) | Expected around 3.2% (varies by month and economic conditions) |

| Previous CPI YoY | 3.0%, indicating a slight acceleration |

| Market Expectation Impact | Buy or sell signals based on divergence from consensus |

Historical Context and Evolution of CPI Release Strategies

The practice of scheduled economic data releases isn’t new. It traces back decades, evolving from ad hoc government disclosures to a structured and predictable calendar designed for market transparency. The BLS, established in the early 20th century, began systematic CPI publication in the 1940s, recognizing the crucial role inflation data play in economic stability and policy formulation.

Over time, high-frequency data dissemination has become refined—incorporating digital updates, real-time dashboards, and immediate market reactions. The 2008 financial crisis, for instance, accelerated efforts toward more rapid and transparent reporting, aiming to reduce informational asymmetry that previously amplified market volatility. Today, the CPI release is a finely tuned part of a broader ecosystem that includes PPI, core inflation, and other peripheral indicators, all calibrated to inform sound decision-making.

The Changing Impact of CPI Announcements

Historically, the market’s reaction to CPI data could be quick but somewhat muted, with delays influenced by less efficient communication channels. Now, with instantaneous news feeds and algorithmic trading, reactions can trigger within seconds—a phenomenon I’ve witnessed firsthand during multiple releases. This instant transmission of information enhances efficiency but also escalates the potential for sudden, sharp swings, demanding that traders stay vigilant.

| Historical Milestone | Impact |

|---|---|

| Introduction of real-time electronic reporting in late 20th century | Faster market responses; increased volatility |

| Post-2008 crisis reforms | Enhanced transparency, but with more rapid reaction cycles |

| Shift toward globalized markets | Decentralized reactions, interconnected market movements |

Addressing Limitations and Preparing for Variability

No matter how well-prepared, annual schedules can sometimes be disrupted. Holidays like Martin Luther King Jr. Day often shift release dates slightly, as do exceptional circumstances such as administrative delays or emergency policy decisions. I remember times when the CPI data was unexpectedly pushed back a day, causing confusion and requiring quick recalibration of strategies.

Strategies for Managing Schedule Deviations

Flexibility is essential. Employing a layered approach—monitoring official schedules, having contingency plans, and staying aware of potential disruptions—can mitigate surprises. Automated alerts, coupled with a nuanced understanding of typical deviations, have helped me navigate these irregularities effectively. Ultimately, being adaptable rather than rigid in your timetable enhances resilience against unpredictable shifts.

| Key Strategies | Application |

|---|---|

| Stay Updated with Official Calendars | Regularly check the BLS website and trusted news sources |

| Use Alerts and Reminders | Set notifications days in advance for security and promptness |

| Plan for Contingencies | Develop flexible trading strategies that can adapt quickly to date shifts |

| Monitor Related Events | Be aware of holidays, political events, or emergencies that may affect scheduling |

Final Reflections and Practical Takeaways

As I’ve observed through years of tracking economic metrics, timing the release of CPI data is less about pinpointing the exact date than about understanding the ecosystem that surrounds it. From leveraging reliable calendars to interpreting market expectations, the knowledge surrounding these schedules arms us with a strategic edge. Experience has taught me that volatility around these days isn’t just inevitable; it’s an opportunity for those prepared to capitalize on the market’s knee-jerk reactions.

In essence, marking your calendar for CPI release dates isn’t just about data acquisition—it’s about integrating these moments into a broader framework of informed analysis. By continuously refining your approach—staying adaptable, aware of historical patterns, and understanding the underlying macroeconomic context—you harness a powerful tool for navigating the complexities of economic markets.

When is the typical release date for CPI data?

+The CPI data is generally released around the 14th to 15th of each month by the Bureau of Labor Statistics, at approximately 8:30 a.m. Eastern Time. Although this timing is consistent, slight variations can occur due to holidays or special circumstances.

How do market participants prepare for CPI release days?

+Market participants utilize economic calendars, set alerts, review consensus forecasts, and monitor related macroeconomic indicators. Following official sources and news outlets helps traders stay ready for rapid reactions and potential volatility.

What factors might cause shifts in the scheduled CPI release date?

+Holidays, government delays, or extraordinary circumstances such as emergencies can cause the release date to shift slightly. Being aware of these possibilities and maintaining flexibility is vital for accurate planning.