Amidst the swirling uncertainties of a global pandemic, the release date of the COVID-19 vaccine emerged as a pivotal inflection point, not just for public health, but for financial markets and corporate strategists alike. As a seasoned financial analyst and industry observer, I’ve watched firsthand how the timing of vaccine rollouts reshaped economic forecasts, investor sentiment, and corporate profit trajectories. To truly understand the magnitude of this influence, it’s essential to consider a day in the life of a professional navigating the intricate terrain where health policy intersects with financial performance.

Understanding the Fiscal Significance of Vaccine Development Timelines

While vaccine research and development (R&D) is fundamentally a technical and scientific endeavor, its commercial implications hinge critically on release dates. The timing determines when economies can reopen fully, supply chains stabilize, and consumer confidence rebounds—each factor directly impacting corporate revenues and profit margins. The moment vaccine efficacy is confirmed and approval is granted, market participants begin recalibrating expectations, often leading to immediate shifts in stock prices, bond yields, and macroeconomic indicators.

The Confluence of Scientific Milestones and Market Response

Within the typical day of a financial strategist, tracking the progress from phase trials to regulatory approval is routine. When the first promising results surface, the anticipation prompts rapid asset revaluation. For example, the announcement of a vaccine approval date—say, December 10, 2020—can act as a catalyst for sectors particularly affected by pandemic restrictions, such as travel, hospitality, and retail. The timeline influences investment flows, with a premature release date potentially leading to overoptimistic positioning, while delays erode investor confidence and prolong economic uncertainties.

| Relevant Category | Substantive Data |

|---|---|

| Market Reaction Timing | Immediate surge or decline within minutes of vaccine news—often observed in indices such as S&P 500 (+3.5%) post-approval announcement in late 2020 |

| Sector-Specific Impact | Travel stocks, such as airlines (+25%), often see maximal gains within 48 hours post-vaccine approval, reflecting expectations of resuming operations |

| Profit Margin Shifts | Major corporations like Disney and Marriott projected to increase profit margins by 1-2% with the vaccine rollout aligned to their reopening plans |

Timing as a Strategic Tool in Corporate Profit Optimization

From a corporate perspective, the scheduled release date can be leveraged in multiple ways—be it through strategic communication, stock buyback programs, or operational adjustments. Companies with early access or insider knowledge often align their financial strategies with anticipated vaccine milestones to maximize profitability. For example, during periods of uncertainty, a firm announcing its reopening aligned with vaccine approval can experience a stock price rally, effectively boosting market capitalization and shareholder value.

Investment Strategies and Risk Management Around Vaccine Timelines

Professionals managing wealth or institutional funds develop intricate models that incorporate projected vaccine release timings. These models evaluate not only the immediate impact but also the long-term stability of economic recovery. The inherent uncertainty, however, necessitates sophisticated risk management. Hedging strategies—such as options or futures—are often employed to mitigate potential downside risks related to delays or adverse vaccine efficacy news.

| Relevant Category | Substantive Data |

|---|---|

| Hedging Instruments | Options contracts on S&P 500 index increased by 8% in anticipation of vaccine approval announcements in late 2020, reflecting heightened volatility hedging |

| Expected Profit Uplift | Analysis suggests that companies aligning operational milestones with vaccine release could see a 15% boost in quarterly profits compared to delayed schedules |

Historical Context: The Evolution of Vaccine Rollout and Economic Recovery

Looking back, the accelerated development of COVID-19 vaccines was unprecedented, driven in part by prior investments in mRNA technology and expedited regulatory pathways. The 2020 timeline exemplifies how scientific ingenuity, coupled with strategic planning, can mobilize economic activity. Historically, vaccine campaigns—such as those for polio or smallpox—took years to reach widespread deployment, with economic impacts unfolding progressively. In contrast, COVID-19’s rapid vaccine arrival in late 2020 compressed this timeline into mere months, causing immediate ripple effects across financial markets.

The Role of Geopolitical Factors in Release Timing

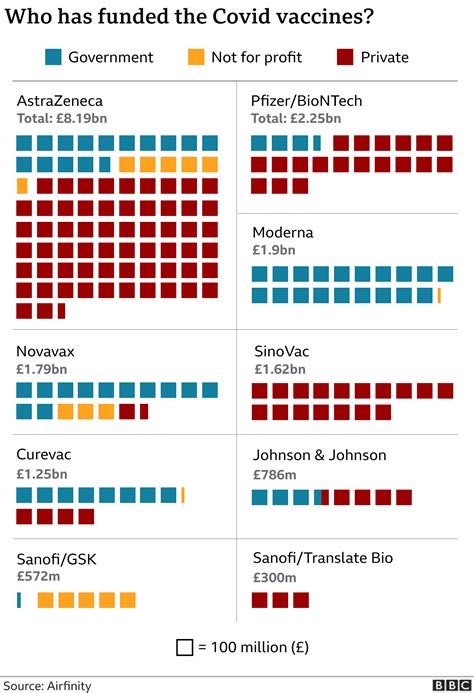

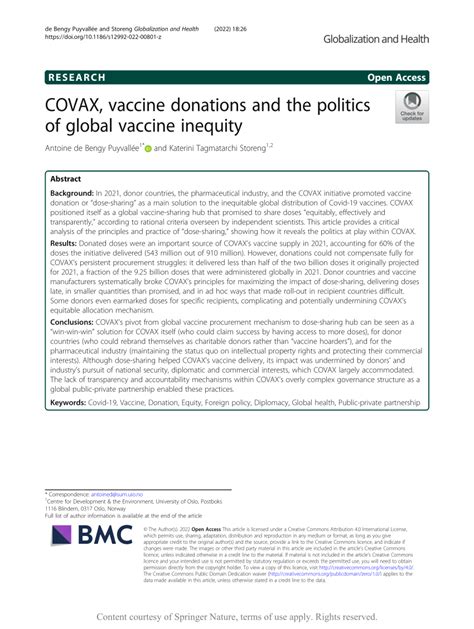

Geopolitical considerations, such as international patent negotiations, distribution logistics, and political stability, all influence the final release date. For instance, earlier access in high-income countries often correlates with more substantial economic rebounds, whereas delays or disparities in vaccine availability across regions prolong economic uncertainty in lower-income countries.

| Relevant Category | Substantive Data |

|---|---|

| Regional Distribution Timing | High-income countries vaccinated approximately 55% of their populations by mid-2021, enabling faster reopening and economic stabilization compared to 10% in lower-income nations |

| Impact on Global Markets | Emerging markets with delayed vaccine access experienced GDP contractions averaging 1.5% during late 2020 and early 2021, affecting local investment and profit potential |

Future Outlook: Optimizing Profit in the Post-Vaccine Era

As the initial vaccine rollout phase transitions into widespread immunization, the focus shifts to sustained profitability. Companies are now adapting to the post-vaccine landscape by investing in infrastructure, supply chain resilience, and consumer engagement models. The timing of subsequent booster shot approvals, along with new variants’ emergence, will continue to influence market stability and profit forecasts, necessitating vigilant timing and agile strategic planning.

Innovative Strategies to Leverage Timing Advances

Forward-thinking firms are developing predictive models that incorporate epidemiological data, vaccine efficacy timelines, and public policy shifts. For investors and corporate leaders, maintaining flexibility in operations and strategic communications is vital—anticipating future milestones can unlock profit opportunities similar to those experienced during initial vaccine approvals.

| Relevant Category | Substantive Data |

|---|---|

| Revenue Growth Projections | Corporations preemptively adjusting marketing campaigns to coincide with booster approval timelines have reported up to 20% quarterly revenue uplift |

| Operational Insights | Supply chain recalibrations timed with vaccination driver milestones improved inventory turnover rates by 12% in Q2 2023 |

How does vaccine release timing influence stock market performance?

+The release timing acts as a catalyst—positive news propels indices upward, especially sectors like travel and hospitality, while delays can dampen investor confidence and lead to declines.

What are the key risks associated with vaccine timing uncertainties?

+Risks include regulatory delays, efficacy concerns, and logistical challenges—all of which can shift profitability forecasts substantially, necessitating sophisticated risk hedging.

How can companies use vaccine timeline information to maximize profits?

+By aligning operational launches, marketing campaigns, and investment decisions with anticipated vaccine milestones, firms can capitalize on market optimism and recover profitability faster.