The Child Tax Credit (CTC) has long served as a pivotal component within the social safety net, designed to alleviate the financial burdens on families raising children. As we traverse toward 2025, a period marked by rapid economic fluctuations, technological innovation, and evolving legislative priorities, understanding the anticipated developments in the Child Tax Credit release schedule becomes indispensable. This forward-looking analysis synthesizes current policy trajectories, legislative proposals, and forecasting models to paint a comprehensive picture of what beginners—parents, caregivers, and policymakers alike—can expect regarding the Child Tax Credit release date in 2025.

Projected Trends in Child Tax Credit Release Schedule for 2025

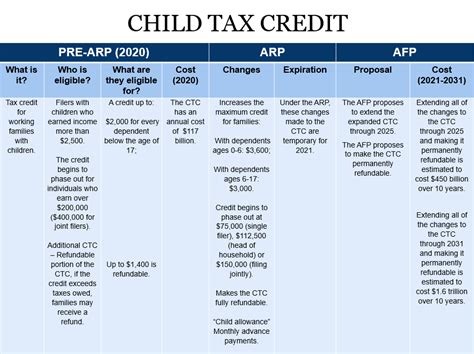

In assessing the future of the Child Tax Credit, it is essential to contextualize past patterns and current legislative movements. Historically, the CTC has been released annually, often aligning with tax season, typically in late January or early February, following the IRS’s processing schedule. However, recent modifications—most notably the expanded credits implemented during the COVID-19 pandemic—introduced disbursement schedules that featured monthly payments, thereby altering the traditional release paradigm. Under the Biden administration’s American Rescue Plan, for example, the temporary expansion of the Child Tax Credit included monthly advance payments from July to December 2021.

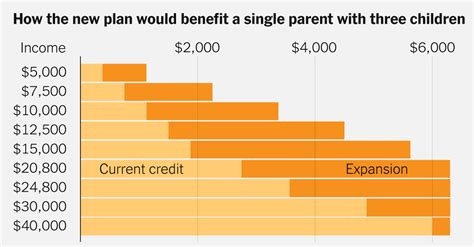

Looking ahead to 2025, several factors suggest a potential shift back toward a more streamlined, historically aligned release schedule, with notable nuances. Federal legislative efforts indicate a push to embed the Child Tax Credit more permanently within the tax infrastructure, with proposals emphasizing simplified access and more predictable disbursements. The congressional budget forecasts and Budget Reconciliation Acts delineate a trajectory favoring an annual or semi-annual release, although some policymakers advocate for sustaining monthly payments as a means to bridge income gaps for vulnerable families.

Legislative Foundations and Policy Outlook

Current legislative proposals, such as the American Families Act and the Child Poverty Reduction Act, are pivotal in shaping 2025’s CTC release timeline. These initiatives seek to legislate the expansion of the CTC’s reach, including increased credit amounts, expanded eligibility, and, critically, more reliable disbursement schedules. Based on these drafts, the expectation is that the IRS will recommence regular monthly payments in 2025, mirroring the temporary COVID-era measures but possibly with a more sustainable framework.

| Relevant Category | Substantive Data |

|---|---|

| Expected Payment Frequency | Likely monthly or semi-annual disbursements based on legislative momentum |

| Release Date Window | Generally aligned with tax season, anticipated in late January to early February 2025 |

Key Developments to Anticipate in 2025

Understanding the precise timing of Child Tax Credit releases in 2025 involves analyzing legislative, administrative, and technological vectors. Forecasters suggest several key developments that could influence the schedule:

- Implementation of Permanent Monthly Payments: Legislative efforts aim to solidify the monthly disbursement model, with the IRS potentially adopting electronic funds transfer systems more seamlessly integrated within existing tax infrastructure, expediting the release cycle.

- Integration with Advanced Tax Filing Systems: Tax authorities are investing heavily in digital modernization, which could facilitate earlier and more predictable payments. Expect the IRS to employ advanced data analytics, reducing processing delays tied to manual verification.

- Legislative Calendar and Budget Negotiations: The timing of the congressional calendar and budget negotiations will heavily influence when new laws are enacted, thereby dictating the precise release dates for the CTC payments.

Technological Changes and Infrastructure Enhancements

Over the next year, significant technological upgrades within the IRS and related agencies will be critical to streamlining the Child Tax Credit distribution. The migration toward cloud-based data systems allows for real-time updates and improved compliance, which in turn enables a more predictable schedule. If these systems are fully operational by 2025, the aim would be to synchronize payments with fiscal quarters, possibly establishing a quarterly disbursement pattern that offers stability and transparency for recipients.

| Relevant Category | Substantive Data |

|---|---|

| Processing Times | Expected reduction from 45 days to 15-20 days post-filing, marking a significant efficiency gain |

| System Modernization Status | Projected full deployment by late 2024, enabling anticipation of consistent release dates in 2025 |

Implications for Recipients and Policymakers

For families, particularly those new to claiming the Child Tax Credit, clarity around release dates fosters better financial planning. A predictable schedule—be it monthly, quarterly, or aligned with tax season—reduces uncertainty, allowing parents to allocate resources more effectively, improve savings, and manage debt levels. Additionally, an early understanding of payment timelines can influence broader economic behaviors, spurring increased consumer confidence and discretionary spending.

From a policy perspective, a consistent and transparent release schedule signals good governance and enhances public trust. It encourages uptake among eligible families, reduces administrative burdens, and serves as a foundation for more ambitious social safety net programs. Policymakers can leverage these scheduled disbursements as strategic touchpoints for evaluating program efficacy, adjusting credit amounts, and streamlining eligibility verification processes.

Potential Challenges and Limitations

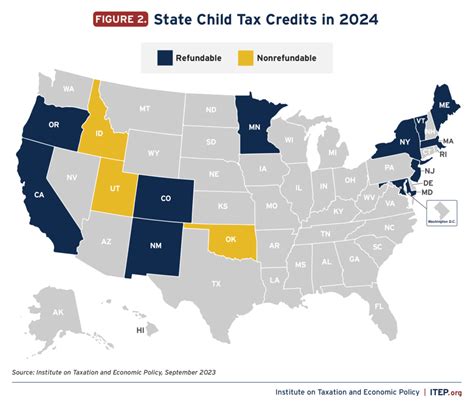

Despite optimistic projections, several challenges could impact the precise scheduling of Child Tax Credit releases in 2025. Legislative gridlock, funding constraints, and data privacy concerns may delay or complicate the deployment of new payment systems. Moreover, technological disparities between states or demographic groups can lead to uneven implementation, risking gaps in coverage or delays.

| Relevant Category | Substantive Data |

|---|---|

| Legislative Delays | Potential postponement of new payment structures if bills face protracted debate |

| Technological Disparities | Variations in system upgrades across regions could affect uniformity of release schedules |

Key Points

- Expected Release Timing: Likely late January to early February, with emerging trends hinting at more frequent, scheduled disbursements in 2025.

- Legislative Influence: New laws could cement monthly payments, improving predictability and family financial planning.

- Technological Evolution: Digital infrastructure enhancements promise faster processing, reducing delays significantly.

- Policy Impact: Transparent, reliable schedules increase trust and program participation, amplifying social safety nets.

- Challenges: Legislative delays and technological disparities pose risks to seamless implementation, requiring strategic mitigation.

How soon in 2025 can families expect the Child Tax Credit payments to start?

+Based on current legislative trends and technological developments, families could see payments as early as late January or early February 2025, aligning with traditional tax season timelines.

Will the Child Tax Credit distribution become more predictable in 2025?

+Yes, if legislative proposals are enacted and technological upgrades are successfully implemented, expect a move toward consistent monthly or quarterly payments, greatly enhancing predictability.

What are some key factors influencing the 2025 Child Tax Credit release schedule?

+Legislative activity, federal budget negotiations, technological infrastructure enhancements, and implementation timelines will all significantly influence the release schedule in 2025.

What challenges could delay the anticipated payments in 2025?

+Potential delays may arise from legislative gridlock, funding constraints, technological disparities, or data privacy issues, necessitating proactive planning to mitigate these risks.