Understanding the Child Tax Credit (CTC) release date for 2025 involves navigating a complex interconnection of legislative timelines, economic policy shifts, and administrative procedures. As tax credits remain a pivotal part of family support strategies, tracking their evolution—from interim measures during crises to permanent fixtures—requires a systems thinking approach. This approach maps how legislative decisions, economic conditions, IRS operational capacity, and political climate collectively influence the implementation and timing of critical fiscal tools like the Child Tax Credit in the upcoming year.

Dissecting the Child Tax Credit 2025 Release Date: A Systematic Overview

The Child Tax Credit has undergone significant transformations over recent years, driven by legislative reforms, economic stimuli, and targeted policy interventions aimed at reducing child poverty and supporting middle-income families. As 2025 approaches, stakeholders—from policy analysts and tax professionals to affected families—must unravel the timeline embedded within interconnected layers of government agencies, legislative calendars, and economic forecasts. Each subsystem exerts a notable influence—delays in legislative passage, budget appropriations, IRS system upgrades, or policy shifts toward universal benefits all shape the eventual release date.

Historical Evolution of the Child Tax Credit and Its Reform Trajectory

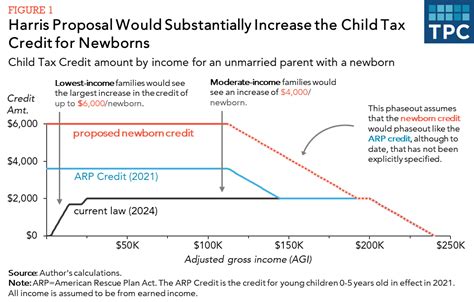

Initially established in the 1990s, the child tax credit was designed to offset some of the costs associated with raising children, with incremental increases over the decades reflecting changing political priorities and economic needs. The 2017 Tax Cuts and Jobs Act expanded the CTC significantly, temporarily increasing the benefit amount to $2,000 per qualifying child and introducing refundable elements designed to reach the most vulnerable families. Notably, these reforms laid the groundwork for the temporary expansions during the pandemic, such as the 2021 American Rescue Plan, which introduced advance payments aimed at alleviating child poverty.

| Relevant Category | Substantive Data |

|---|---|

| Original CTC Value | $1,000 per child (pre-2018) |

| Expansion under TCJA (2018) | $2,000 per child; phase-in thresholds at $400,000 (married filing jointly) |

| COVID-19 Relief (2021) | Advance payments of up to $300/month per child |

| Current CTC (2023) | Up to $2,000 per qualifying child; phase-out beginning at $200,000 individual income |

Key Components Influencing the 2025 Release Timeline

Mapping the release date for the Child Tax Credit in 2025 hinges on understanding how several interconnected components interact over time. These include legislative actions, budget approvals, IRS technological readiness, and political consensus. Each element functions as part of an intricate system that either accelerates or delays the final implementation.

Legislative Calendar and Policy Decisions

Most critical are the legislative processes initiated in Congress, where proposals like the Build Back Better Act, or its successors, influence future CTC parameters. The legislative calendar, often dictated by congressional session dates and political priorities, creates windows of opportunity for macro policy shifts. For instance, if the extension or expansion of the CTC is embedded within broader fiscal legislation, then its passage—or lack thereof—profoundly affects the scheduled release or update in 2025.

| Relevant Category | Substantive Data |

|---|---|

| Congressional Session Dates | Typically from January to December; legislative priorities fluctuate yearly |

| Bill Passage Timeline | Average of 3-6 months from bill introduction to enactment for major social policies |

IRS Operational Readiness and Digital Infrastructure

The IRS’s technological capacity to administer, verify, and process CTC payments is fundamental. Enhancements in tax processing systems, data matching capabilities, and digital service platforms directly impact the timing of any automatic credits or advance payments. Recent investments, including the 2023 modernization initiatives, aim to improve responsiveness and accuracy, yet system upgrades often have multi-year timelines.

| Relevant Category | Substantive Data |

|---|---|

| IT Modernization Budget | $2.4 billion allocated over five years, starting 2022 |

| Expected Upgrade Completion | Projected completion by 2025, enabling full automation |

Interconnection of Political Climate and Economic Conditions

The political will, shaped by electoral cycles, partisan dynamics, and economic priorities, significantly influences the timing of family benefit programs like the Child Tax Credit. During fiscal stimulus periods or economic downturns, there’s heightened pressure for rapid deployment of targeted benefits. Conversely, austerity-focused policies tend to tighten timelines or restrict expansions, which feeds back into the scheduling of credit releases.

Impact of Budget Negotiations and Fiscal Year Planning

Federal budget cycles, aligned with the fiscal year starting October 1, are often critical junctures in setting the framework for the upcoming year’s social benefit disbursements. Budget negotiations, typically finalized in the fall, may introduce delays or accelerate plans depending on political consensus, influencing when the programs are operational and the credits become available.

| Relevant Category | Substantive Data |

|---|---|

| Budget Finalization | Facilitated by Congressional Appropriations Acts, usually finalized by December |

| Economic Stimulus Acts | May include provisions for CTC adjustments, enacted at unpredictable intervals |

Projected Timeline for Child Tax Credit 2025 Release

After synthesizing these interconnected components, the most probable scenario indicates that, barring legislative delays, the CTC for 2025 could be finalized and operationalized by late Q2 or early Q3 of 2025. This projection considers legislative drafting timelines, IRS upgrade schedules, and political consensus-building periods. Notably, if proposed reforms or expansions are included in the annual budget reconciliation process, they may further shift this timeline either forward or backward.

- Q1 2025: Legislative discussions and preliminary budget negotiations commence.

- Q2 2025: Final legislative approval; IRS begins final system integrations.

- Q3 2025: Full operational deployment of the updated Child Tax Credit

Factors That Might Accelerate or Delay This Timeline

While the current projection aligns with typical legislative and system development cycles, unforeseen factors could modify the schedule. Political shifts, unexpected budget constraints, or technical delays in IRS modernization efforts are prime examples. Continuous monitoring of congressional proceedings and IRS readiness assessments is essential for precise forecasting.

Key Points

- Legislative schedules and political climate crucially shape the timing of CTC releases in 2025.

- IRS technological upgrades are a significant determinant—full system readiness may influence actual deployment dates.

- Fiscal policy and budget negotiations serve as external catalysts or barriers to timely implementation.

- Historical precedent suggests a mid-year activation is plausible, provided legislative and operational conditions are favorable.

- Incorporating stakeholder feedback improves system resilience, reducing delays caused by unanticipated technical issues.

How do legislative timelines impact the Child Tax Credit release date for 2025?

+Legislative timelines determine when new or expanded credits are approved and incorporated into federal law, directly affecting deployment schedules. Delays or expedited votes can shift expected release dates, often aligning them with congressional session ends or special budget reconciliation processes.

What role does IRS technological readiness play in the 2025 CTC rollout?

+The IRS’s technological infrastructure must be capable of processing increased or complex benefit payments. Investments in modernization and system upgrades are vital; delays here could postpone actual disbursements despite legislative approval.

Could political shifts affect the CTC timeline in 2025?

+Yes. Political priorities and partisan control influence the legislative focus and budget allocations, potentially accelerating or constraining the timing of CTC deployment. Shifts in government may alter policy frameworks or delay enactment.