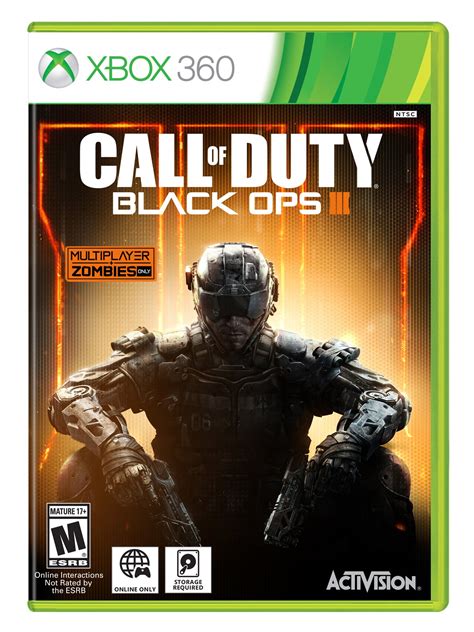

Amidst the fervor of the gaming community and the ever-evolving landscape of interactive entertainment, the release of Call of Duty: Black Ops III stands as a significant event not only for its gameplay innovations but also for its implications within the financial markets. Tracing back to its origins, the Call of Duty franchise emerged in 2003, steadily ascending to global dominance with each successive release. Its adaptability across console generations and commitment to blending cinematic storytelling with first-person shooter mechanics have cultivated a dedicated, ever-growing user base. This historical trajectory reveals that the franchise's success is intertwined with strategic release cycles, technological innovation, and market anticipation, all of which influence how investors can maximize gains surrounding new entries, particularly Black Ops III.

The Evolution of Call of Duty and Market Impacts

The franchise’s initial foray into World War II settings reflected an early strategic choice, resonating strongly with players and establishing a firm foothold in the competitive FPS genre. As technology advanced, the transition to modern warfare in titles like Modern Warfare and the futuristic themes of Black Ops III demonstrated a pattern of innovation that kept the franchise fresh and economically lucrative. Each release has historically generated significant revenue, often breaking sales records — for example, Black Ops II sold over 24 million copies worldwide. These milestones underscore the franchise’s capacity to stimulate both consumer spending and stock market activity, particularly for Activision Blizzard, its parent company.

Market Dynamics and Investor Considerations

Investors closely monitor release timelines and related pre-market signals to optimize financial gains. For Black Ops III, the strategic timing of the release—anticipated to occur during the fourth quarter—aligns with the holiday shopping season, a period historically associated with heightened consumer demand. Such timing not only boosts immediate sales but often leads to elevated stock prices for Activision Blizzard, driven by anticipated revenue uplifts. Examining past data, Activision’s stock has demonstrated notable upticks following major franchise launches, sometimes by as much as 3-5%. Understanding these historical patterns enables investors to anticipate market movement and position themselves accordingly, especially through options and short-term trading opportunities based on upcoming game releases.

| Relevant Market Metric | Historical Data & Context |

|---|---|

| Stock Increase Post-Release | Activision Blizzard's stock often rises 3-5% in the week following major releases like Black Ops titles |

| Revenue Shotps | Black Ops II generated approximately $1.1 billion worldwide within its first 12 months |

| Pre-Order Trends | Pre-orders for Call of Duty titles have consistently represented 45-55% of total sales pre-launch |

Timing the Release: Strategic Insights for Financial Optimization

Understanding the historical release patterns of Call of Duty: Black Ops III provides a tactical advantage for investors aiming to capitalize on its launch. Typically, Activision Blizzard announces the release date about three to six months in advance, allowing for pre-market speculation and positioning. The timing often overlaps with earnings reports or industry events like E3, adding layers of market complexity. Pre-release hype augmented by targeted advertising campaigns and influencer partnerships substantially influences consumer behavior, which in turn affects market perception and investor confidence.

Pre-Launch Activities and Investment Strategies

Investors may consider acquiring shares ahead of official announcements or during the pre-order window. Given the consistent pattern of revenue surges, a common strategy entails purchasing call options with expiry dates aligned to the release period, capitalizing on anticipated stock jumps. Additionally, monitoring social media buzz and pre-order numbers serves as qualitative data points that complement quantitative analysis. For instance, a spike in pre-orders or positive sentiment on investor forums generally presages a stock movement upwards, offering an opportunity for early entry.

| Investment Tactic | Illustrative Example |

|---|---|

| Pre-Release Buying | Acquire shares or call options 1-2 months prior to the release based on historical performance indicators |

| Post-Launch Selling | Sell after the initial sales surge, typically within 2-4 weeks, to realize gains |

| Hedging Strategies | Use options to hedge against volatility or delayed sales performance in uncertain markets |

Long-term Value Creation and Franchise Management

Beyond immediate trading opportunities, the long-term significance of Black Ops III hinges on franchise lifecycle management. The strategic release of downloadable content (DLC), expansions, and continued community engagement sustains revenue streams and bolsters stock valuation over time. Historical analysis reveals that post-launch periods characterized by consistent content updates correlate with prolonged sales momentum and investor optimism. Furthermore, developments like esports integration and cross-platform play extend franchise relevance across broader demographics, translating into sustained profitability.

Analyzing the Franchise’s Evolution for Future Gains

By dissecting the lifecycle stages—launch, growth, maturity, and renewal—market participants can anticipate periods of stability or acceleration. For instance, the release of a significant expansion pack or a crossover event often catalyzes renewed investor interest, reminiscent of patterns observed in other entertainment sectors like movies or streaming services. Evidence suggests that strategic timing of these initiatives can lift the franchise’s brand equity and, consequently, investor confidence, reinforcing the importance of a holistic, long-term perspective.

| Relevant Data Point | Implication for Investors |

|---|---|

| Post-Launch Content Updates | Correlate with sustained revenue inflows and enhanced franchise valuation |

| ESports Integration | Increases audience engagement, expanding monetization opportunities |

| Cross-Platform Features | Broaden demographic reach, stabilizing earnings streams |

Conclusion: From Historical Roots to Financial Strategies

Tracing the historical evolution of the Call of Duty franchise underscores how meticulous timing, content strategy, and community engagement have historically driven both consumer success and stock performance. For Black Ops III, understanding its release cycle within this broader context enables traders and investors to craft nuanced, evidence-based strategies aimed at maximizing financial returns. From pre-launch anticipation and tactical options trading to long-term franchise development, the interplay of market anticipation and sustained content innovation offers fertile ground for those seeking to harness the franchise’s full economic potential.

When is the expected release date for Call of Duty: Black Ops III?

+While official announcements vary, historical patterns suggest a release in late October to early November, aligning with holiday shopping trends and previous franchise cycles.

How can investors leverage the Black Ops III release for financial gains?

+Strategic positioning involves buying shares or options pre-release based on historical revenue spikes, monitoring pre-order data, and timing sales around post-launch market surges. Long-term strategies include tracking franchise content updates and community engagement metrics.

What risks are associated with investing around gaming releases?

+Market volatility, unpredictable consumer response, and technological or competitive disruptions pose significant risks. Diversification and robust analysis of franchise health help mitigate these uncertainties.