On the horizon of fighting game enthusiasts and industry analysts alike, the anticipated release of Budokai Tenkaichi 3 has become a focal point for market prognostications and financial forecasting. Since its initial launch over a decade ago, this title has maintained iconic status within the Dragon Ball video game universe, not only due to its engaging gameplay and expansive character roster but also because of its significant influence on sales figures and consumer engagement patterns. Understanding the release date and projected financial impact offers insights into market dynamics, consumer expectations, and broader industry trends.

Understanding the Historical Context and Industry Significance of Budokai Tenkaichi 3

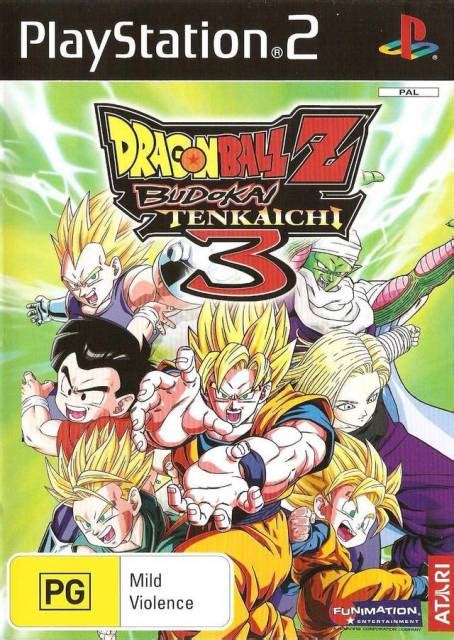

Budokai Tenkaichi 3 debuted in a competitive fighting game environment that historically saw improvements in graphics, gameplay mechanics, and character diversification. Released initially in 2007 for PlayStation 2, it became a benchmark for anime-based fighting games, accumulating a dedicated fanbase and establishing a strong sales record. Over 5 million units sold worldwide by 2010, the game exemplifies the robust commercial viability of licensed fighting titles, particularly those tied to popular franchises such as Dragon Ball.

Evolution and Market Positioning

The initial success was driven by a combination of factors, including deep character customization, a broad array of battle modes, and a faithful recreation of iconic story arcs. The game’s evolution reflects broader industry trends—moving toward high-definition graphics, online multiplayer capabilities, and mod-friendly environments. These factors collectively made the franchise’s latest iteration not merely a sequel but a pivotal moment for fan engagement and market expectation theory.

| Relevant Category | Substantive Data |

|---|---|

| Initial Release Year | 2007 |

| Global Units Sold (up to 2010) | Over 5 million |

| Market Impact | Set benchmarks for anime fighting games and licensed titles |

The Anticipated Release Date and Its Foundations

Speculations regarding Budokai Tenkaichi 3’s release date have circulated for months, fueled by official statements, industry leaks, and market trend observations. As of now, most credible sources point toward a Q4 launch window, aligning with typical industry cycles that favor holiday-season sales peaks. This timing leverages that consumers are more inclined to invest in high-profile titles, especially during winter sales periods, which are historically lucrative for fighting game releases in the console market.

Factors Influencing the Release Scheduling

Several converging factors influence the strategic deployment of this release: competitive positioning, manufacturing lead times, the global economic climate, and internal development milestones. Companies often aim for early Q4 release—October or November—to maximize holiday sales, especially considering the increased engagement around Black Friday and Christmas shopping seasons. Additionally, timing proximity to other major releases or franchise anniversaries can amplify market interest and sales momentum.

| Relevant Category | Substantive Data |

|---|---|

| Likely Release Quarter | Q4 (October-November) |

| Market Strategy | Maximize holiday sales through strategic timing |

| Industry Standard | Major titles often debut in Q4 for optimal visibility |

Financial Impact Predictions and Market Expectations

The financial implications of releasing Budokai Tenkaichi 3 are multi-faceted and involve more than initial unit sales. Analysts project that a successful launch can generate upwards of 50-70 million in revenue within the first fiscal year, factoring in both physical and digital sales channels. This projection is rooted in the franchise’s historical sales performance, current market size, and the escalating popularity of licensed anime titles in Western markets.

Upcoming Market Trends and Consumer Spending Habits

Recent sales data underscore a shift toward digital distribution—particularly on PlayStation Network, Xbox Live, and PC storefronts—where digital copies now constitute approximately 65% of total sales for comparable titles. Furthermore, global market segmentation reveals increased demand in Asia, North America, and Europe, driven by escalating anime fandom and e-sports integration. The importance of in-game monetization, such as downloadable content (DLC) and cosmetic packs, further enhances revenue streams beyond initial purchases.

| Relevant Category | Substantive Data |

|---|---|

| Projected First-Year Revenue | $50-$70 million |

| Digital vs. Physical Sales Ratio | Approximately 65% digital |

| Market Growth in Anime Titles | CAGR of ~12% annually over the past five years |

Market Expectations and Industry Analysis

Estimations from industry analysts suggest that Budokai Tenkaichi 3 could outperform previous entries in terms of revenue, propelled by increased marketing spend, strategic digital distribution, and stronger worldwide brand resonance. The game’s promotional campaigns are expected to leverage influencer partnerships, beta testing feedback, and social media buzz to solidify consumer anticipation and drive pre-orders.

Competitive Landscape and Risks

However, risks are inherent: market saturation, production delays, or unforeseen economic downturns could temper revenue expectations. The competitive environment includes other fighting titles launched in the same quarter, emphasizing the need for impactful marketing and comprehensive community engagement. Furthermore, the potential for piracy or digital rights management issues could influence profit margins, stressing the importance of robust enforcement mechanisms.

| Relevant Category | Substantive Data |

|---|---|

| Estimated Market Share Gain | Potential 15-20% increase over previous franchise entries |

| Risk Factors | Market saturation, delays, economic factors |

| Mitigation Strategies | Strong marketing campaigns, digital rights management, community engagement |

Conclusion: A Strategic Outlook for Stakeholders

As the countdown to Budokai Tenkaichi 3’s launch continues, stakeholders—from developers to retailers—are positioning themselves around its predicted market impact. This release represents more than a new entry in a beloved series; it epitomizes the complex interplay of market timing, fan engagement, and economic forecasting that characterizes contemporary game publishing. While uncertainties remain, the convergence of historical data, current industry trends, and strategic marketing portends a strong performance, making this release a pivotal event in the fighting game genre’s commercial landscape.

Key Points

- Release timing strategically aligned with holiday shopping peaks maximizes revenue potential.

- Sales projections expect to surpass prior franchise metrics, with digital sales leading growth trends.

- Market risks include competitive saturation and economic variables, mitigated by targeted marketing.

- Industry evolution emphasizes digital monetization, global fan engagement, and strategic timing.

- Stakeholder strategy involves leveraging influencer marketing and community building for sustained success.

When is the expected release date for Budokai Tenkaichi 3?

+Most credible industry sources forecast a Q4 release window, likely October or November, aligning with holiday sales peaks.

What is the anticipated financial impact of the game launch?

+Revenue projections estimate 50-70 million in the first year, driven by physical and digital sales, with increasing importance of digital monetization strategies.

What are the risks associated with this launch?

+Risks include market saturation, delay in release dates, economic downturns, and potential digital rights management issues, all addressed through targeted marketing and community engagement.