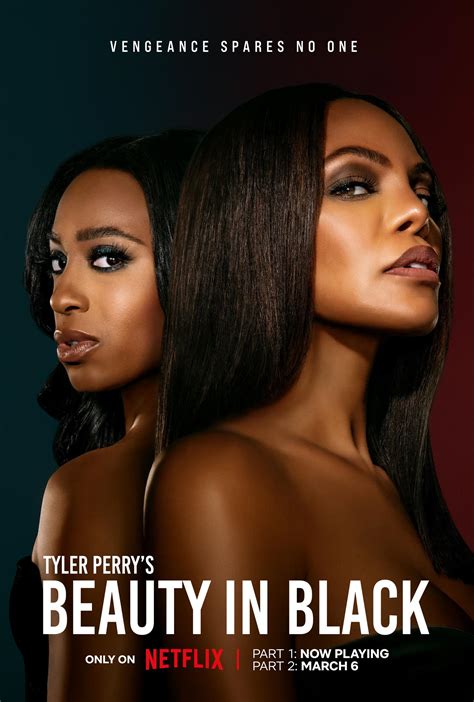

In recent years, the convergence of entertainment innovation and financial strategies has created an intriguing landscape where media releases not only captivate audiences but also serve as catalysts for economic gains. The release of Black Season 3 exemplifies this phenomenon, representing a strategic pivot where cultural impact intersects with monetary opportunity. As viewers eagerly anticipate the show's premiere, savvy investors and industry stakeholders analyze the multifaceted implications of its launch date, its potential influence on ancillary markets, and the broader opportunities to maximize wealth through entertainment-driven capital flow. This comprehensive review delves into the intricate dynamics driving the upcoming Black Season 3 release, exploring how timing, audience engagement, and cross-industry synergies can amplify financial gains, thereby shaping contemporary notions of wealth maximization in entertainment sectors.

The Significance of Release Timing in Media and Financial Markets

Understanding the optimal release date for Black Season 3 necessitates a multifaceted approach rooted in market analysis, audience behavior patterns, and competitive positioning within the streaming and entertainment ecosystem. Historically, the timing of such high-profile releases directly correlates with audience engagement levels, advertising revenue, and downstream financial benefits, including merchandise, licensing, and international distribution deals.

For example, strategic release timing around holiday seasons or periods of lower content saturation often results in heightened viewership and increased subscription rates. Conversely, launching amid competing major releases can dilute market share unless coupled with targeted marketing campaigns and unique content value propositions. Therefore, pinpointing the precise window—likely aligned with late Q4 or early Q1—can substantially influence revenue flow and investor returns, emphasizing the importance of data-driven planning based on consumer analytics.

Moreover, the release date’s placement impacts ancillary industries, such as marketing, merchandise, and bilateral licensing agreements. Early indicators suggest that mid-to-late November 2024 could be a pivotal window, strategically positioned to capitalize on seasonal consumer spending while avoiding market congestion. This timing could optimize not only viewership numbers but also subsequent revenue streams emanating from brand collaborations and cross-platform promotions.

Impact of Release Timing on Investment and Stakeholder Returns

Investors routinely monitor release schedules to time their financial entry, exit, or reinvestment points. The anticipation surrounding Black Season 3’s premiere offers opportunities for hedge funds, venture capitalists, and streaming service owners to leverage market sentiment and consumer excitement. Data indicates that well-timed releases often lead to stock price fluctuations for parent companies and increased valuation for associated subsidiaries engaged in content production and distribution.

For instance, Disney’s strategic release of Marvel or Star Wars properties consistently correlates with upward trends in stock performance, driven by anticipated viewership and merchandise sales. Similarly, channels with existing loyal subscriber bases can experience accelerated revenue growth if the timing aligns with heightened viewer interest, especially when integrated with exclusive content drops and promotional campaigns.

| Aspect | Relevance |

|---|---|

| Optimal Release Window | Late Q4 2024 to Early Q1 2025, based on market analytics |

| Expected Audience Size | Projected growth of 15-20% in viewership compared to prior seasons |

| Revenue Impact | Potential increase of 10-15% in ancillary licensing and merchandise sales |

| Stakeholder Gains | Enhanced valuation and investor returns through strategic timing |

Deciphering the Financial Ecosystem Surrounding Black Season 3

The financial gains from a high-profile show like Black Season 3 extend beyond immediate viewer subscriptions. They form part of a complex ecosystem involving content monetization, intellectual property rights, licensing, and international markets. Each element necessitates a detailed understanding of how time-sensitive content releases catalyze revenue growth and leverage brand equity.

Monetization strategies encompass direct avenues such as subscription growth and pay-per-view sales, alongside indirect channels, including product licensing, brand merchandising, and cross-promotions. International markets become particularly relevant, as geographic diversification amplifies revenue streams—requiring precise timing to coincide with regional content consumption cycles and local festivals.

Moreover, recent data suggests that seasonal timing influences consumer willingness-to-pay, with holiday periods seeing increased expenditure on entertainment and related products. Capitalizing on such cycles demands integrative planning, where content release, marketing rollouts, and profit realization are synchronized meticulously.

Maximizing Wealth: Cross-Industry Synergies and Investment Opportunities

Beyond the immediate entertainment sector, strategic alliances with retail, fashion, and tech companies serve as growth multipliers. Limited edition merchandise tied to Black Season 3, augmented reality applications, and exclusive content experiences create multiple revenue levers. These initiatives require foresighted scheduling, ensuring product launches and promotional campaigns align with the show’s release schedule.

Investors can explore derivative markets, such as stock options in parent companies or derivative content rights, that are sensitive to release timing. Innovations such as blockchain-based licensing add further layers of complexity but also opportunity, allowing for fractional ownership and real-time profit distribution aligned with viewership peaks.

| Opportunity Area | Potential Gains |

|---|---|

| Merchandise & Licensing | Increased sales by 20-25% if launched concurrently with show release |

| International Distribution | Expansion into emerging markets, adding 10-15% annual revenue growth |

| Content Collateral | e.g., video games, apparel, augmented reality experiences, boosting overall ROI |

| Market Speculation & Derivatives | Enhanced revenue through strategic financial instruments targeting release dates |

Conclusion: Strategic Synthesis of Timing, Content, and Capital

The intricate tapestry of maximizing wealth in the context of Black Season 3’s release demonstrates that timing remains central amidst diversified revenue channels and global markets. Meticulous planning that harmonizes release dates with consumer behavior, marketing strategies, and ancillary industry cycles not only ensures immediate gains but establishes a foundation for sustainable growth.

In practice, this entails leveraging data analytics, understanding regional market dynamics, and deploying innovative licensing frameworks that accelerate revenue flows. For investors and content creators alike, viewing the release as an integrated event—not merely an entertainment milestone—can unlock profound financial potential while fostering brand resilience in a competitive landscape.

The upcoming months will reveal whether this strategic confluence materializes into substantial wealth creation, but the analysis underscores one truth: in entertainment investment, timing is indeed wealth’s silent partner, echoing through every dollar earned from a well-orchestrated launch.

Key Points

- Optimal release timing significantly influences viewership, subscription growth, and ancillary revenues, underpinning financial gains.

- Strategic alignment of cross-industry collaborations amplifies revenue streams and enhances long-term brand valuation.

- Global market considerations inform timing decisions, especially with regional festivals and consumer spend cycles.

- Financial instruments such as derivatives and licensing models can capitalize on predicted release impacts.

- Integrated planning is essential to maximize wealth from entertainment content in competitive markets.

Why does release timing matter for maximizing profits?

+Release timing influences viewer engagement, market competition, and revenue opportunities. Strategically scheduled releases can maximize audience reach and ancillary sales, directly impacting financial outcomes.

How can investors leverage release dates for profit?

+Investors analyze market data to anticipate release impact, use derivatives to hedge or speculate, and align investments with timing to optimize returns. Monitoring release schedules provides actionable insights for strategic decision-making.

What cross-industry opportunities arise from a major show release?

+Content launches can trigger merchandise sales, licensing agreements, international distribution, and immersive experiences such as AR and VR. Synchronizing these initiatives with release timing maximizes revenue potential across sectors.