When considering the financial pulse of one of the world's most expansive tech giants, Amazon, knowledge of its earnings release schedule is akin to understanding the circadian rhythm of a complex organism. The company's quarterly earnings serve not only as a barometer for its economic health but also as a compass guiding investors, analysts, and industry observers through the tumultuous waters of e-commerce, cloud computing, and digital services. As we approach the first quarter of 2025, conversations around Amazon's earnings release date have intensified, driven by anticipation of strategic shifts, market pressures, and evolving consumer behaviors. In this detailed exploration, we will dissect the typical timing of Amazon's Q1 2025 earnings release, the factors influencing this schedule, and what stakeholders stand to glean from the forthcoming data, all while contextualizing within Amazon's broader corporate and industry landscape.

Understanding Amazon’s Earnings Release Schedule: The Financial Calendar in Context

To decode Amazon’s anticipated Q1 2025 earnings release date, it is essential to comprehend the broader framework of corporate earnings calendar traditions, Amazon’s historical release patterns, and the operational nuances that shape reporting timelines. Amazon, like many large-cap public companies listed on NASDAQ, adheres to a quarterly reporting cycle, with earnings typically announced shortly after the fiscal quarter concludes. These dates are influenced by regulatory requirements, internal financial closing procedures, and strategic timing considerations aimed at maximizing transparency and market impact.

Historical Patterns and Regulatory Framework

Since its initial SEC filings and public listing, Amazon has generally released quarterly earnings within a few weeks following the close of each fiscal quarter. The SEC mandates companies to file Form 10-Q for each quarter, typically within 40 days of quarter-end, often prompting earnings announcements during this window. Historically, Amazon has preferred to release its earnings between 15 to 25 days after quarter-end, balancing thoroughness with timeliness. For Q1, which ends on March 31, this generally positions the release in mid-April.

| Relevant Category | Substantive Data |

|---|---|

| Typical Release Window for Q1 | Between April 15 and April 25, 2025 |

Factors Influencing the Exact Date of Amazon’s Q1 2025 Earnings Release

While historical patterns provide a baseline, several variables can shift the precise date of Amazon’s upcoming earnings announcement. Recognizing these factors enhances stakeholder readiness and strategic planning.

Operational and Regulatory Considerations

Coordination of financial closure, audit processes, and regulatory filings influence the timing. Amazon’s internal finance teams must ensure that all quarterly data—especially in areas as complex as Amazon Web Services (AWS) revenue, Prime membership metrics, and logistics expenses—are thoroughly validated. Unanticipated delays in financial audits or data reconciliation could push the release date beyond the typical window.

Market Timing and Competitive Landscape

Amazon often considers the timing relative to key industry events. For example, scheduling earnings publication around earnings season peaks, major product launches, or industry conferences (like AWS re:Invent) could be a tactical decision. Additionally, external factors such as macroeconomic conditions, regulatory scrutiny, or geopolitical developments might induce premature or postponed disclosures.

Strategic Communication and Investor Expectations

Amazon’s corporate communication team aligns the earnings release with investor relations strategies, aiming for maximum transparency and positive perception. The company may choose a specific date to optimize media coverage, analyst ratings, and shareholder engagement, especially when significant capital market actions or outlook updates are anticipated.

| Impactful Factors | Description |

|---|---|

| Financial audit completion | Ensures accuracy and regulatory compliance, potentially delaying the release if delays occur |

| Market calendar positioning | Aligns with other earnings reports for comparative analysis and market impact |

| External macroeconomic events | Influences timing to avoid adverse market reactions |

| Strategic corporate initiatives | Releases timed to coincide with product or executive announcements |

Market Expectations and Analyst Forecasts for Q1 2025

As the tentative date nears, analyst consensus begins to coalesce, providing a predictive lens into what the earnings report might reveal. Typical expectations revolve around revenue growth trajectories, margin pressures, and the company’s stance on future investment areas.

Revenue Projections and Growth Drivers

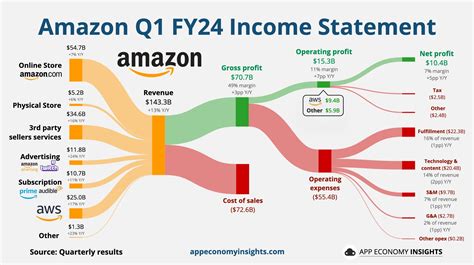

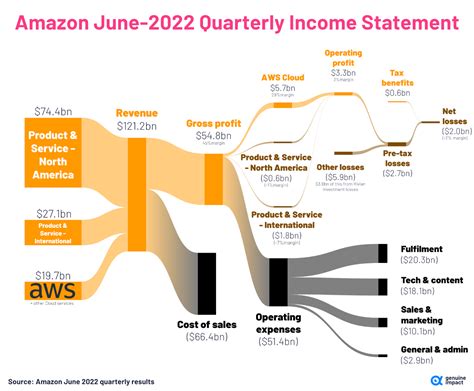

Analysts broadly anticipate Amazon to report revenue surpassing $130 billion for Q1 2025—representing an approximate 10-12% year-over-year increase, driven primarily by continued expansion in cloud services and e-commerce sales globally. Notably, AWS remains a cornerstone, contributing an estimated 12-15% of total revenue but a disproportionately high segment margin.

Profitability and Margin Dynamics

Market watchers forecast a net profit margin stabilization around 3-4%, contingent on expense management, supply chain efficiencies, and pricing strategies amidst inflationary pressures. Operating margins are scrutinized, given recent investments in logistics infrastructure and AI-enabled logistics optimization.

| Financial Metric | Forecasted Value |

|---|---|

| Revenue | $132 billion (approx.) |

| Net Income | $3.5 billion (approx.) |

| Revenue Growth | Approximately +11% YoY |

| Operating Margin | ~4% |

Looking Beyond the Numbers: Strategic and Industry Implications

The earnings reveal is not solely about immediate financial health but also provides a window into strategic priorities and competitive positioning. Amazon has been investing heavily in AI, logistics automation, and sustainability initiatives—each aspect influencing earnings and their presentation.

Strategic investments and future outlook

Investors will be examining the company’s commentary on supply chain resilience, new market penetration, and long-term growth strategies, viewing the Q1 report as a compass for the year ahead. The narrative surrounding AI integration into Amazon’s operations and its implications for efficiency and customer experience will feature prominently.

Industry-wide echoes

Amazon’s earnings serve as a bellwether for the broader tech and retail sectors. Any surprises—positive or negative—can ripple across markets, influencing investor sentiment and prompting reassessments in related industries like logistics, cloud computing, and digital advertising.

Key Points

- Anticipated Q1 2025 earnings release between April 15-25, aligning with historical patterns but subject to strategic and operational factors.

- Forecasted revenue around $132 billion, with continued growth driven by AWS and international e-commerce expansion.

- Profitability margins remain under pressure from inflation, logistics costs, and competitive pricing, making operational efficiency critical.

- The earnings report offers insights into Amazon's strategic pivots toward AI, sustainability, and logistics innovation.

- Market implications extend beyond immediate financials, influencing sectoral valuations and investor strategies worldwide.

When specifically will Amazon release its Q1 2025 earnings?

+Based on Amazon’s historical patterns and regulatory timelines, the Q1 2025 earnings are likely to be announced between April 15 and April 25, 2025. Exact timing will depend on internal audit completion and strategic considerations.

What are the key factors that could shift the earnings release date?

+Factors include delays in financial audits, conflicting market events, regulatory review processes, and strategic timing of company announcements. External macroeconomic pressures may also influence scheduling.

What should investors focus on in Amazon’s Q1 2025 earnings report?

+Investors should examine revenue growth components, profitability margins, commentary on cloud computing (AWS), international expansion, and strategic investments in AI and logistics. The qualitative guidance on future outlooks will be equally informative.