In the world of finance, corporate earnings releases stand as pivotal moments that can either reinforce investor confidence or prompt sharp reevaluations. As we approach the first quarter of 2025, the earnings seasons are poised to deliver critical insights into the economic health of major corporations. Among these, the release date for Alphabet's Q1 2025 earnings is anticipated to attract significant attention from analysts, investors, and market strategists alike. This article aims to dissect the underlying expectations, contextualize the event within the broader economic and technological landscape, and elucidate what stakeholders should look for when Alphabet unveils its financial results.

Understanding the Significance of Earnings Release Dates

An earnings release date is not merely a timestamp on the corporate calendar; it is a carefully coordinated event rooted in comprehensive financial reporting cycles and regulatory compliance. For publicly traded companies like Alphabet Inc., scheduled quarterly earnings disclosures are mandated by the Securities and Exchange Commission (SEC) and are instrumental in maintaining market transparency. The precise timing influences trading strategies, stock valuations, and even informed policymaking. As such, the anticipation surrounding Alphabet’s Q1 2025 earnings reveals much about market sentiment, company trajectory, and sector dynamics.

The Timeline and Expectations for Alphabet’s Q1 2025 Earnings

Most large-cap technology firms, including Alphabet, tend to report earnings within a consistent quarterly window—typically between late April and mid-May. For Q1 2025, analysts forecast that Alphabet will adhere to this norm, with the release likely scheduled for the second or third week of May 2025. This window coincides with the busy earnings calendar and affords management adequate time to compile and audit financials post-quarter close.

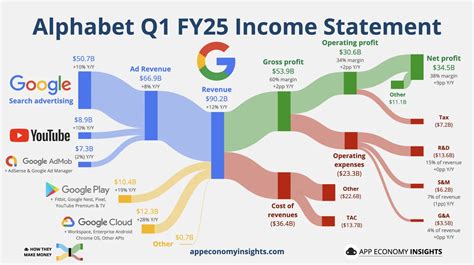

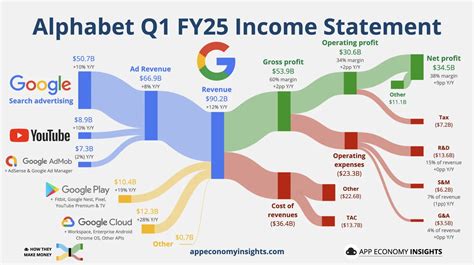

Consensus estimates point toward an earnings per share (EPS) of approximately 1.45, reflecting moderate growth compared to previous periods. Revenue projections hover around 75 billion, signifying a potential uptick driven by advertising revenue, cloud services, and Other Bets. However, these figures are subject to revision as macroeconomic factors, regulatory pressures, and technological shifts mature.

| Relevant Category | Substantive Data |

|---|---|

| Historical Release Pattern | Alphabet traditionally reports Q1 earnings between mid- and late-May, aligning with industry norms. |

| Analyst Consensus EPS | Approx. 1.45 per share, with a variance of ±0.10 based on macroeconomic conditions and internal performance.</td></tr> <tr><td>Revenue Estimates</td><td>Around 75 billion, boosted by growth in cloud and advertising sectors. |

Key Drivers and Risks Heading into the Q1 2025 Earnings

Several primary factors will shape Alphabet’s Q1 financial disclosure. First, the trajectory of digital advertising remains paramount. As global ad spend shifts amid economic uncertainties, Alphabet’s core revenue stream could either accelerate or face headwinds. Second, the cloud segment has grown rapidly, with Google Cloud expected to contribute significantly to top-line growth. Third, the regulatory environment worldwide—particularly in the United States, European Union, and India—continues to influence operational strategies and financial outcomes.

Advertising Revenue and Market Dynamics

Digital advertising formed approximately 80% of Alphabet’s total revenue in 2024, with Google Search and YouTube being dominant players. The pandemic-era surge in online activity has plateaued, but gradual shifts toward automation, personalization, and AI-driven ad targeting are expected to sustain revenue. However, macro challenges like inflation, supply chain disruptions, and policy tightening on data privacy could temper growth prospects.

Cloud Computing and Diversification

Google Cloud’s revenue has been rising at an annual rate of approximately 30%, surpassing 30 billion in 2024. This segment is now increasingly strategic, serving enterprise clients and developing robust AI/ML capabilities. Its performance in Q1 will likely influence investor sentiment regarding Alphabet’s diversification strategies amid competitive pressures from Amazon, Microsoft, and emerging players.</p> <table> <tr><th>Relevant Category</th><th>Substantive Data</th></tr> <tr><td>Advertising Growth Rate</td><td>Estimated around 10-12% YoY in Q1 2025</td></tr> <tr><td>Cloud Revenue Growth</td><td>Projected +30% YoY, reaching ~8-9 billion Regulatory Scrutiny ScoreHigh, with key investigations in EU and US ongoing

Potential Catalysts and Market Reactions

Beyond raw financials, several qualitative factors could move markets post-earnings. Strategic announcements, such as new product launches, updates on AI integration, or key acquisitions, can act as catalysts. Additionally, management commentary on future outlooks, investment priorities, and regulatory challenges provides vital context.

Implications for Investors and Stakeholders

Shareholders will scrutinize the EPS and revenue figures against estimates for signs of acceleration or deceleration. A beat could propel the stock higher, signaling robust performance and investor confidence. Conversely, a miss—especially amid rising regulatory headwinds or macroeconomic cooling—might result in increased volatility or downward pressure.

Furthermore, analyst calls and investor presentations are likely to focus on growth modalities, cost management, and strategic positioning for the second half of 2025.

| Market Response Indicators | Expected Trends |

|---|---|

| Stock Price Volatility | Increased around release date, depending on results and commentary |

| Analyst Revisions | Potential upward or downward revisions based on earnings surprises |

| Institutional Swings | Major funds may adjust positions based on overall earnings trajectory |

Forecasting the Broader Impact and Future Trajectory

Looking beyond the immediate earnings report, Alphabet’s first-quarter results will shape strategic decisions for the coming months. Robust performance could reinforce dollar-cost averaging strategies, spur investment in AI initiatives, or fast-track regulatory compliance initiatives. Weaknesses or surprises might prompt recalibration, including cost-cutting measures or shifts in operational focus.

Furthermore, these results will serve as a barometer for the entire technology sector, reflecting investor confidence amid broader economic malaise or optimism fueled by innovations in artificial intelligence, cloud computing, and data analytics.

Industry Comparisons and Competitive Context

In comparison to peers like Microsoft, Amazon, and Meta, Alphabet’s earnings provide insight into sector resilience. While each company faces unique challenges—regulatory, technological, or consumer-driven—the collective trend delineates a sector in transition, balancing innovation with compliance.

| Key Competitor | Q1 2025 Outlook |

|---|---|

| Microsoft | Strong cloud growth, AI product launches expected to boost revenue |

| Amazon | Continued e-commerce recovery, expanding AWS footprint |

| Meta | Rebound in ad sales, focus on Metaverse investments |

Final Considerations and Strategic Advice

For investors and analysts preparing for Alphabet’s Q1 2025 earnings release, a balanced approach rooted in both data and strategic foresight is advisable. Prioritize understanding the nuanced interplay between financial metrics, regulatory developments, and technological trends. Maintain awareness of external macroeconomic signals—such as interest rate shifts, geopolitical tensions, and inflation data—that can modify market interpretations.

In conclusion, while earnings seasons traditionally serve as quarterly check-ins, their implications often ripple far into the future. Alphabet’s upcoming release, anticipated within the familiar window of mid-May 2025, will serve not just as a financial report but as a pivotal indicator of the company’s resilience, innovation capacity, and strategic agility as it navigates an intricate landscape of opportunity and challenge.

When is the expected release date for Alphabet’s Q1 2025 earnings?

+The release is anticipated in mid-May 2025, aligning with the company’s historical pattern and industry standards for quarterly reporting.

What are the main factors influencing Alphabet’s financial performance in Q1 2025?

+Key drivers include advertising revenue trends, cloud services growth, regulatory environment developments, and strategic investments in AI and other emerging technologies.

How should investors interpret Alphabet’s earnings results?

+Investors should analyze both the quantitative metrics—EPS, revenue, growth rates—and qualitative signals like management commentary and market positioning to gauge long-term prospects.

What could cause market volatility around the earnings release?

+Variations from expectations in financial figures, unexpected guidance changes, or geopolitical/regulatory news can trigger volatility post-earnings.

What is the broader significance of Alphabet’s Q1 2025 earnings for the tech sector?

+The results will serve as a benchmark for sector resilience, innovation trends, and regulatory navigation, informing strategic decisions across the technology industry.