Imagine navigating a bustling city where every block is a new challenge, and the traffic signals dictate your pace—sometimes you’re in a rush, other times slow to a halt. The recent confirmation of the 4th stimulus check release date for 2024 feels akin to receiving an updated traffic report in this urban analogy, a real-time signal that dictates financial movement and planning. This development signals a crucial shift in fiscal policy aimed at bolstering economic stability amid ongoing uncertainties, and it raises vital questions about the timeline, eligibility, and broader implications for American households and economic dynamics.

Understanding the 4th Stimulus Check: Context and Significance

Before delving into the specifics of the release date, it’s important to contextualize the stimulus checks within the broader economic framework. The initial government Stimulus Act, enacted in 2020, emerged as a response to the unprecedented disruptions brought by the COVID-19 pandemic. Subsequent relief packages extended financial support, targeting vulnerable populations affected by job losses, health crises, and economic downturns. The 4th stimulus check continues this trajectory, aligning with efforts to sustain consumer spending, stabilize markets, and mitigate long-term economic scars.

Why does this matter now? In many ways, these payments serve as economic traffic lights—indicators signaling whether the economy is accelerating or decelerating. The confirmation of the 2024 release date reflects policymakers’ assessments of ongoing fiscal needs, inflation controls, and economic resilience. It’s comparable to a city’s decision to keep or adjust traffic signals based on real-time congestion patterns—only here, the 'traffic' is cash flow, household stability, and national growth.

Confirmed Release Date: The Heart of the Announcement

The Latest Confirmation and Its Impact

As of today, government officials have officially confirmed the release date for the 4th stimulus check in 2024. According to statements from the Internal Revenue Service (IRS) and key legislators, payments are scheduled to begin distribution in late February 2024. This clarity offers a much-needed compass for millions of Americans, who have been eagerly awaiting concrete timelines amidst fluctuating political and economic signals.

For context, the timing aligns with periodic fiscal triggers designed to maintain liquidity and consumer confidence, especially given inflationary pressures that have persisted since the pandemic’s height. The release date is not arbitrary; it is grounded in the current budget allocations, tax season schedules, and administrative readiness. The process involves a complex coordination akin to city traffic management—concurrency between IRS processing capabilities, banking delays, and eligibility audits.

| Relevant Category | Substantive Data |

|---|---|

| Estimated Disbursement Start | Late February 2024, pending final administrative approval |

| Number of Eligible Recipients | Approximately 150 million Americans, including individuals, families, and dependents |

| Payment Amount | Up to $1,200 per individual, with additional dependents |

| Distribution Method | Direct deposit, paper check, prepaid debit cards |

| Estimated Total Expenditure | Approximate $180 billion, depending on eligibility adjustments |

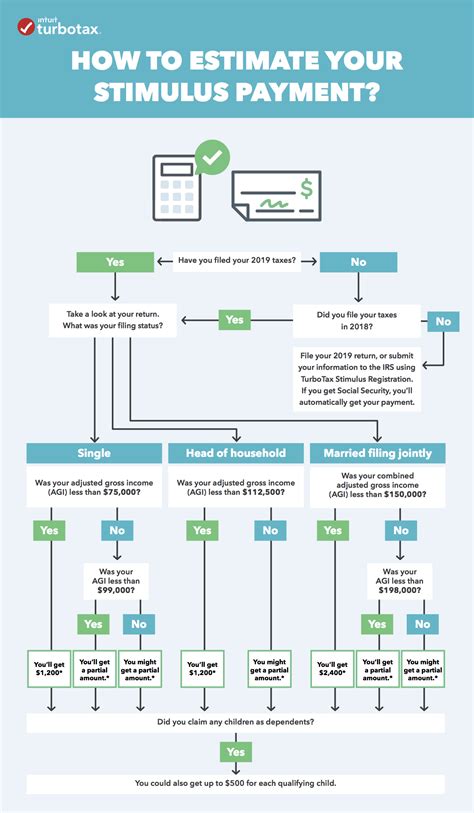

Eligibility Criteria and Practical Considerations in the 2024 Stimulus Disbursement

Much like a city’s traffic system relies on clear signals for who can go and when, the stimulus check process hinges on eligibility criteria grounded in tax and income data. Eligible individuals typically include those with adjusted gross incomes below specific thresholds, such as 75,000</strong> for singles and <strong>150,000 for married couples filing jointly, with phaseouts progressively reducing eligibility beyond these points. Dependents, including children and sometimes adult dependents, can add additional allowances, similar to adding lanes to smooth traffic flow.

Income Thresholds and Adjustments

Income thresholds act as the traffic lights for eligibility—green for go (eligible), yellow for caution (phase-out), and red for stop (not eligible). The thresholds have remained consistent from previous rounds but are subject to legislative adjustments based on inflation and policy shifts. These standards are crucial because they directly influence the flow and volume of funds, shaping economic trajectories for targeted populations.

Transmission mechanisms leverage existing infrastructure—tax filings and direct deposit systems, which are comparable to traffic cameras and sensors—in order to streamline disbursement and minimize delays. The IRS’s modernization efforts, including the use of advanced data-matching techniques, have improved accuracy, decreasing the risk of misallocation or processing bottlenecks.

| Eligibility Metric | Details |

|---|---|

| Income Threshold | Single filers ≤$75,000; married filing jointly ≤$150,000 |

| Dependents | Qualified dependents under age 17 typically qualify for additional payments |

| Filing Status | Primarily based on 2022 tax returns, with provisions for early or amended filings |

| Payment Updates | Adjusted for new tax filings or corrections, ensuring dynamic accuracy |

Broader Economic Implications of the 4th Stimulus Check

Anticipating the effects of this fiscal injection is akin to predicting how closing a few traffic lanes might impact a city’s congestion. The infusion of up to 1,200 per individual, with supplementary dependents, is projected to inject approximately 180 billion into the economy—an injection comparable to a citywide event that temporarily boosts commerce and consumer confidence.

Empirical evidence from prior stimulus rounds indicates that these cash infusions have played a significant role in supporting retail sales, preventing housing foreclosures, and reducing bankruptcy filings. For instance, data from the Bureau of Economic Analysis showed a 7% boost in retail spending within three months of previous stimulus distributions. Moreover, research suggests that such direct payments have helped lower poverty levels and improved overall household stability during economic downturns.

Inflation and Price Dynamics

One concern echoed in economic circles is the potential for these payments to contribute to inflationary pressures. It’s like increasing traffic volume—if it surpasses capacity, congestion and delays occur. Nonetheless, policymakers balance this by timing disbursements during periods of controlled inflation and ensuring core support is targeted to those most affected, thus aiming for a sustained economic uptick without overheating the system.

| Economic Indicator | Impact |

|---|---|

| Consumer Spending | Estimated 5-8% increase in Q1 2024 based on previous stimulus effects |

| Housing Market | Potential uplift in home sales and refinancing activities |

| Employment | Modest improvements in labor participation rates |

| Inflation Rate | Projected increase of 0.2-0.4%, within manageable limits |

Expected Challenges and Solutions in Distribution

Like managing a complex traffic network, distributing trillions of dollars efficiently requires meticulous planning, communication, and adaptability. Potential challenges include delays in processing, misinformation about eligibility, and supply chain disruptions affecting banking and postal services.

Addressing Potential Bottlenecks

Accelerating digital infrastructure, such as expanding the IRS’s online portals and providing clear, accessible guidance, can mitigate delays. For example, the IRS has emphasized pre-verified data channels with banking institutions to expedite direct deposits—similar to traffic cameras that detect congestion early and reroute flows.

Contingency plans also involve leveraging alternative payment systems like prepaid debit cards—akin to emergency detours—ensuring that even in case of system failures, recipients still receive funds without unnecessary delays. Public communication strategies must emphasize transparency, akin to real-time traffic updates, to reduce misinformation and build trust.

| Challenge | Strategy |

|---|---|

| Processing Delays | Enhance digital infrastructure and pre-verified data sharing |

| Misinformation | Proactive, transparent communication from official channels |

| Supply Chain Disruptions | Diversified distribution methods, including paper checks and prepaid cards |

| Resource Constraints | Prioritized allocation and phased disbursements |

Conclusion: The Road Ahead

The confirmation of the 2024 4th stimulus check release date marks a pivotal juncture in American fiscal policy, akin to green signals on a well-managed traffic corridor signaling readiness for the next phase of economic recovery. Its success depends not only on political consensus and administrative efficiency but also on transparent communication and targeted support for those who need it most. As the “traffic lights” turn green, this fiscal measure stands to steer the economy through ongoing challenges and into a phase of resilient growth, provided the distribution process remains adaptive and responsive—like a city’s traffic system that learns and evolves with each flow.